New Life Equity Release Review (2025): Is It Right for You?

Be aware. Equity release comes with drawbacks which are important to think about. Lifetime mortgages are secured loans. Compound interest means the amount you owe can grow quickly. Equity release reduces your estate's value and may impact means-tested benefits.

Be aware. Equity release comes with drawbacks which are important to think about. Lifetime mortgages are secured loans. Compound interest means the amount you owe can grow quickly. Equity release reduces your estate's value and may impact means-tested benefits.Key Takeaways

- Equity release is a financial product which allows homeowners aged 55 and above to unlock the value tied in their property without selling it.

- It functions by providing a loan against the value of your home, which is repaid when the property is sold, usually upon death or moving into long-term care.

- The pros and cons include increased financial freedom and liquidity (pros), potentially offset by high interest rates and a reduction in your estate's value (cons).

- It is generally considered safe for retirement, as it is regulated by the Financial Conduct Authority and carries no risk of repossession as long as the terms are adhered to.

- To apply, you typically need to contact a qualified financial adviser who can guide you through the application process, ensuring you understand all the implications and potential risks involved.

EveryInvestor is an unrelated 3rd party information website and the opinions in this article are our own and do not necessarily reflect the views or opinions of New Life.

Who’s the best equity release provider, you may ask?New Life Equity Release may be just what you need to find the most suitable provider for your circumstances.

With equity release gaining popularity in the UK, we’re sure you must wonder what all the fuss is about.

If you’re a retiree, equity release can help you access a significant portion of your home’s capital and, as a result, really change the quality of your golden years.

In This Article, You Will Discover:

Our expert financial team at EveryInvestor have spent hours sifting through all the relevant market data on equity release brokers and providers so we can bring you the best information.

Find out what we’ve learnt about New Life Equity Release!

Who Is New Life Equity Release?

New Life Equity Release is an advisory company that was established by Rachel Rowley and Julie Bilsby.

These 2 partners boast over 40 years of experience in the financial sector.

They have chosen to specialise as an advisory and sourcing service for equity release in the form of lifetime mortgages.

What Is Meant by 'Equity Release'?

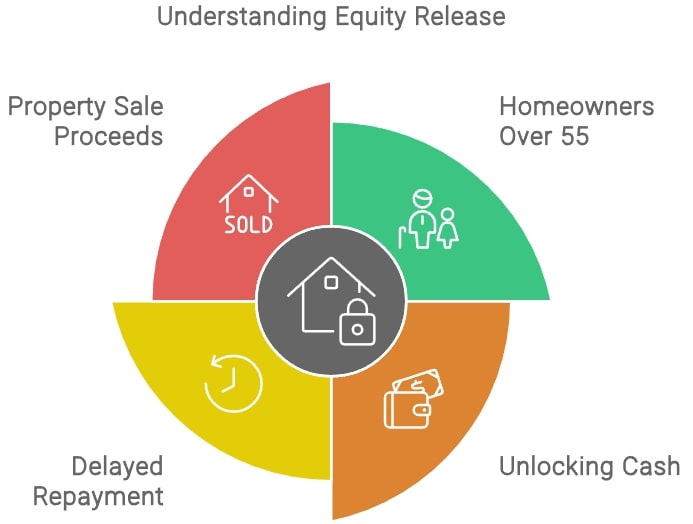

Equity release provides a path for homeowners over 55 to turn their property's equity into usable funds, without having to sell.

It's a financial route to unlock cash from your home's value.

The loan and its interest are repaid from the property's sale proceeds, typically after the homeowner's death or transition to care.

This delayed repayment feature is a key characteristic of equity release.

Learn More: Equity Release Above 50

Why Consider New Life Equity Release

You may consider New Life Equity Release if you are looking for an exceptionally experienced equity release advisory service.

With more than 40 years' combined experience in various parts of the financial sector, including banking and equity release, you’d be hard-pressed to find better equity release partners.

New Life Equity Release’s clients attest to the excellent advice they receive and the superior level of service offered to them.

What Services Does New Life Equity Release Offer?

New Life Equity Release offers financial advisory services as well as the sourcing and arranging of equity release plans from leading providers.

The advisers at New Life Equity Release specialise in lifetime mortgages.

Does New Life Equity Release Offer Equity Release or Lifetime Mortgages?

New Life Equity Release does not offer equity release itself, but brokers equity release plans provided by leading equity release lenders.

New Life Equity Release advises on and arranges lifetime mortgages, and can refer you to a specialist if you'd like to discuss home reversion plans.

New Life Equity Release & the Schemes It Recommends.

The equity release schemes offered by New Life Equity Release brokers are lifetime mortgages.

The service sources lifetime mortgages from top providers to ensure its clients get the best product for their needs.

New Life Equity Release does not advise on home reversion plans, but the company could refer you to a reliable home reversion advisor if needed.

New Life Equity Release & Market Related Equity Release Interest Rates?

New Life Equity Release doesn’t have its own equity release scheme with specific interest rates.

Interest rates1 on lifetime mortgages usually range from 5.97% to 6.28%*, depending on your age, property value, and plan type.

View the equity release interest rates here.

*While we regularly review our rates, these may have changed since our last update.

What Are New Life Equity Release’s Fees?

New Life Equity Release offers an initial appointment for free; the fee it charges after that is £1,295.00 for an equity release application.

Does New Life Equity Release Have An Equity Release Calculator?

Yes, New Life Equity Release does have an equity release calculator on its website.

The results will give you an estimate of the amount you could potentially release.

Before you try the New Life calculator, find out what you can release by using our quick and easy equity release calculator, which you can find here.

What Are The Advantages & Disadvantages of New Life Equity Release?

The advantages and disadvantages of New Life Equity release include that it’s an advisory service and doesn’t offer its own products; however, it gives independent advice.

New Life Equity Release Pros

The pros of New Life Equity Release include that it's an independent equity release adviser.

Here are more details.

- The initial appointment is free of charge.

- It's an expert advisory firm that specialises in equity release products.

- Its focus is on lifetime mortgages.

- The service is long-term and relationship-oriented.

- New Life Equity Release is a member of the Equity Release Council.

- Its services are regulated by the Financial Conduct Authority.

New Life Equity Release Cons

The cons of New Life Equity Release are that it’s not a direct provider of its own products and that it does not provide its services nationwide.

Here are more details.

- A Lifetime mortgage arrangement fee is payable.

- If you need home reversion, then New Life Equity Release can only refer you to a provider.

- Services are only available to those living in the Cotswolds and the South West.

- Lifetime mortgages will decrease your estate’s value (irrespective of whose advice you receive).

How Did We Review the Info on New Life Equity Release?

We reviewed the information available on New Life Equity Release by collating all relevant facts about its services to provide you with our findings.

New Life Equity Release Customer Reviews

New Life Equity Release has received an aggregated 4,8-star review from its clients.

The company's speedy response times and great customer service have received the most praise.

New Life Equity Release Complaints

If you need to lodge a complaint with New Life Equity Release, you can do so by emailing the details of your complaint as well as your relevant account information directly to the company.

You can contact the company in the following ways:

By post - Addressed to The Complaints Department

HL Partnership Limited

2nd Floor, Unit 1

Southern Gate Office Village

Southern Gate

Chichester

West Sussex

PO19 8GR

- By email: complaints@hlpartnership.co.uk

- By telephone: 03300 552 651

New Life Equity Release will try its best to resolve your complaint in 3 business days; however, if it can’t, it’ll write to you to advise you that it's investigating.

You can expect a final resolution no later than 8 weeks after the date of your complaint.

New Life Equity Release FCA Details

Trading Names

New Life Equity Release Ltd

FCA Permitted Services

New Life Equity Release Limited is an appointed representative of HL Partnership Limited.

Regulators

- Financial Conduct Authority

- Equity Release Council

Registration Numbers

- Financial Conduct Authority: 944590

- Company Registration Number: 13098073

New Life Equity Release Contact Number & Address

- +44 1453 453 154

- Hello@newlifeequityrelease.co.uk

- Unit 701 Stonehouse Park, Sperry Way, Stonehouse, Gloucestershire GL10 3UT

Common Questions

New Life Equity Release is a type of equity release scheme available in the UK for individuals aged 55 and above.

It allows homeowners to access the equity tied up in their property, providing them with a lump sum or regular income while still retaining ownership.

With New Life Equity Release, you can enjoy financial freedom in retirement by unlocking the value of your home without the need to sell it.

New Life Equity Release works by allowing homeowners to borrow against the value of their property.

The borrowed amount, along with any interest accrued, is repaid when the property is sold, typically after the homeowner passes away or moves into long-term care.

The loan amount and interest rates are determined by factors such as the property value, the homeowner’s age, and health.

It is important to carefully consider the terms and conditions of the plan, as it can impact inheritance and future financial plans.

The pros of New Life Equity Release include accessing tax-free cash, the ability to continue living in your home, and the flexibility of choosing a lump sum or regular income.

However, it’s important to consider the cons as well. These may include the potential impact on inheritance, the accrual of interest over time, and the possibility of negative equity if property values decrease.

It is recommended to seek independent financial advice to understand the specific pros and cons based on your individual circumstances.

New Life Equity Release is a regulated financial product, providing certain consumer protections. It is important to work with reputable providers who adhere to the industry standards set by the Financial Conduct Authority (FCA).

Additionally, the Equity Release Council sets standards for equity release providers, ensuring transparency and safeguards for consumers.

Before considering New Life Equity Release or any other equity release scheme, it is advisable to seek professional advice from a qualified equity release specialist.

Learn More: The ERC and Setting Industry Standards

To apply for New Life Equity Release, you will need to go through a series of steps. Firstly, it is recommended to seek independent financial advice to understand if equity release is suitable for your circumstances.

Once you have decided to proceed, you can contact New Life Equity Release directly or work with an independent adviser who can guide you through the application process.

The provider will assess your eligibility based on factors such as your age, property value, and health. It’s important to carefully review the terms and conditions before finalizing the application.

Yes, New Life Equity Release is a member of the Equity Release Council².

New Life Equity Release is owned by its 2 founding directors, Rachel Rowley and Julie Bilsby, and is an appointed representative of HL Partnership Limited.

New Life Equity Release doesn’t have a specialised jobs webpage at this stage but you could contact them directly to find out of any job openings.

New Life Equity Release does not do equity release directly, but it does arrange equity release loans from various market-leading providers for clients.

Yes, New Life Equity Release is a safe advisory company. The company is a member of the Equity Release Council and is regulated by the FCA (Financial Conduct Authority).

In Conclusion

When you’re looking into equity release and considering a specialist adviser, New Life Equity Release is a good option to explore.

It's a specialist advisory service for equity release products and looks specifically at lifetime mortgages from market-leading later-life lenders.

Equity release can be a daunting process, and you’ll need an expert like New Life Equity Release to guide you through it.

Found an Error? Please report it here.

100% private. No pressure. Just friendly guidance.

100% private. No pressure. Just friendly guidance.