Selling a House With Equity Release in 2025: What You Must Know

Be aware. Equity release comes with drawbacks which are important to think about. Lifetime mortgages are secured loans. Compound interest means the amount you owe can grow quickly. Equity release reduces your estate's value and may impact means-tested benefits.

Be aware. Equity release comes with drawbacks which are important to think about. Lifetime mortgages are secured loans. Compound interest means the amount you owe can grow quickly. Equity release reduces your estate's value and may impact means-tested benefits.Key Takeaways

- When you sell a UK property with equity release, the outstanding loan plus any accrued interest must be repaid at completion from the sale proceeds. Any surplus funds go to you.

- Equity release plans in the UK often carry ERCs between 0–25% of the outstanding balance, commonly around 5%–25%, depending on the lender and how early you repay.

- UK estate agents typically charge between 0.9% and 3.6%, with the average at 1.42% (Incl. VAT). For a £300,000 sale, that’s around £4,260 in commissions.1

- Obtain a settlement figure valid for ~28 days, confirm any ERCs and lender fees, work with an agent familiar with your area, and aim to time the sale for when market conditions support the maximum resale.

If you've taken out an equity release plan—such as a lifetime mortgage—you’re not locked into your property forever.

It is possible to sell your home, but doing so requires you to repay the loan in full, including all accrued interest. You may also face early repayment charges (ERCs) unless your plan includes downsizing protection or porting options.

In the UK, changing personal or financial circumstances—like downsizing to reduce costs, or relocating to be nearer family—are common reasons for considering a sale after equity release.2

But while it’s possible, the process isn’t simple. You’ll need to navigate legal requirements, lender conditions, and property sale logistics with care.

Whether you're looking to relocate, restructure your finances, or simply explore your rights as a homeowner, this guide offers the expert insight you need to move forward confidently.

What Is Equity Release and How Does It Work?

Equity release is a financial product available to UK homeowners aged 55 or older that lets you unlock the cash tied up in your property—either through a tax-free lump sum, regular withdrawals, or both. It enables you to access your home’s value without selling it or moving out.

The money you borrow—plus any compound interest—is usually repaid when you die or move into long-term care, typically from the sale of your property.

Two Main Types of Equity Release in the UK

- Lifetime Mortgage (Most Common Option)

You borrow against the value of your home while retaining full ownership. Interest is added to the loan (compounded), and the total amount is repaid from your estate when you die or enter care. - Home Reversion Plan

You sell part (or all) of your home to a provider in exchange for a lump sum or monthly income. You retain the right to live in the property rent-free for life, but ownership transfers to the provider.

Understanding how interest rates, loan-to-value ratios, and early repayment conditions vary between products is essential. Lifetime mortgages, for example, may offer features such as drawdown facilities, no negative equity guarantees, or downsizing protection.

Before choosing an equity release scheme, speak with an FCA-regulated adviser and request a Key Facts Illustration (KFI) to fully understand costs, risks, and your long-term obligations.

Can I Sell My House With a Lifetime Mortgage or Home Reversion Plan?

Yes—you can sell your house even if you’ve taken out equity release, but the outstanding loan and any accrued interest must be repaid at or before completion.

NOTE: If you’ve taken a Lifetime Mortgage or Home Reversion Plan, selling is considered a "trigger event" that ends the plan.

Portability and Downsizing

Some equity release agreements include a 'portability' clause, allowing you to transfer the debt to a new property—this can offer flexibility if you wish to move without repaying the loan immediately.

- Many Lifetime Mortgage products include portability, allowing you to transfer your plan to a new home—if it meets the lender's criteria.3

- A growing number of plans now include downsizing protection, allowing for penalty-free repayment if moving to a smaller property after five or more years. As of Q1 2025, approximately 70–75% of new lifetime mortgage products included this feature.4

Before making any decisions, consult with a financial advisor or your equity release provider, as they can provide guidance specific to your situation and explain the implications of selling your home.

Why People Sell Post-Equity Release

You might sell your home with equity release to strategically tap into your property’s equity, offering financial support for retirement or other needs while allowing you to remain in your home.

Here are a few reasons people sell post-equity release:

- Downsizing: Nearly 30% of those over 55 consider it, but only about 14% of over-75s complete the move—often because of financial complexity .

- Relocation: To be closer to family, or for lifestyle reasons.

- Accessing Funds: In Q1 2025, there were 5,620 new lifetime mortgages, a year-on-year increase of 11%, with homeowners often using cash for home improvements or healthcare.

What Are the Risks of Selling a House With Equity Release?

Assessing the risks of selling a house with equity release involves understanding potential financial impacts, such as early repayment charges and adjustments to the equity release terms, which could affect the final amount recoverable from the sale.

Consider these risks:

- Early Repayment Charges (ERCs) - ERCs typically range from 0%–10% of the outstanding balance, but specific plans can go higher. These fees decline over time, but it’s essential to check your schedule.5

- Impact of Compound Interest - Interest on some lifetime mortgages compounds quickly. For example, a £40,000 loan at 7.09% APR may grow to ~£79,300 in 10 years.6

- Potential Property Value Drop - If house prices fall before you sell, the equity left after loan repayment may be limited—refer to the UK House Price Index for regional changes.

- Provider Rejection on Porting - Plans may be refused if the new property is non-standard (such as a flat above commercial premises or in a remote location).7

It's essential to discuss your options with a qualified financial advisor to determine if the benefits outweigh the risks based on your personal circumstances.

How Does the Sale Process Work With Equity Release?

Understanding the process of selling a house with equity release requires knowing that the equity release loan must be repaid from the sale proceeds, which may also include handling any associated fees and ensuring all legalities are observed.

By following these steps, you can sell your property with an existing equity release plan and ensure that the loan is repaid correctly.

- Notify your provider and request a settlement figure, valid for ~28 days.

- Select a suitable estate agent—ideally one experienced with equity release sales.

- List the property while monitoring lender-settlement deadlines.

- Complete the sale – proceeds go first to repay the provider; any surplus is yours.

Could I Take My Equity Release Loan With Me?

Yes, you can—this is called “porting” your equity release loan.

Many lifetime mortgage plans in the UK include portability, allowing you to move to a new home without repaying the loan, as long as the new property meets your provider’s lending criteria.

How Does Porting Work?

- You sell your current property, and the proceeds are used to repay the outstanding loan.

- Simultaneously, the same loan is transferred to your new property, which becomes the new security for the lender.

What are the Conditions for Porting?

Equity release providers will typically assess whether your new home is:

- A suitable type of property (e.g. not a holiday let or retirement flat).

- In a location they lend in (some exclude Northern Ireland, the Channel Islands, or remote rural areas).

- Of standard construction and good condition.

If the new property’s value is lower than your current home, you may be asked to repay part of the loan to reduce the lender’s risk.

Common Porting Restrictions

According to the Equity Release Council, portability is a feature of nearly all new lifetime mortgage products, but approval remains subject to underwriting checks and property assessments.

Your provider may reject the transfer if:

- The property is non-standard (e.g. timber-framed, high-rise flat).

- The location is outside their lending region.

- The new property doesn’t provide sufficient security.

Portable vs Non-Portable Equity Release Plans

When planning a move after taking equity release, it’s vital to understand whether your loan is portable. This determines if you can transfer the plan to a new property or must repay it entirely.

The table below breaks down the key differences to help you make an informed choice.

| Feature | Portable Plan | Non-Portable Plan |

|---|---|---|

| Move Without Repayment | ✅ Yes – You can move home and transfer the plan | ❌ No – You must repay the loan in full if you move |

| Property Assessment Required | ✅ Yes – New property must meet provider’s criteria | 🔄 Not applicable |

| Partial Repayment if Downsizing | 🔶 Sometimes – If new home is of lower value, you may repay a portion | ✅ Full repayment required |

| Early Repayment Charges (ERCs) | ❌ Typically avoided if porting is approved | ✅ Often apply unless the plan includes downsizing protection |

| Suitable For | Homeowners planning to move but retain long-term use of equity release | Homeowners who do not expect to move or prefer to repay if circumstances change |

| Flexibility | ✅ High – More adaptable for changing needs | ❌ Limited – Tied to the original property |

| Availability (2025) | ✔ Common – Most new plans include this feature | ✔ Still available – Older or niche products may lack portability |

Pro Tip: If portability is important to your future plans, ask your adviser for a Key Facts Illustration (KFI) that confirms the plan's portability terms—and get pre-approval before committing to a new property.

Always speak to a qualified, FCA-regulated equity release adviser before planning a move. They can help pre-assess the suitability of your new property and liaise with your provider to avoid costly surprises.

What Is Downsizing Protection and Why Does It Matter?

Downsizing protection is a valuable feature in many modern lifetime mortgage plans.

It lets you repay your loan early without early repayment charges (ERCs) if you move to a smaller or less suitable home that doesn’t meet your lender’s porting criteria.

When It Applies

- You’re moving to a lower-value property.

- Your new home fails porting checks (e.g., non-standard construction or location).

- You’ve held the plan typically for around 5 years or more.

With this feature, you can sell your home, clear the loan, and avoid hefty ERCs, offering significant flexibility for later-life moves.

How Common Is Downsizing Protection?

As of early 2025, the Equity Release Council data shows there are over 300 equity release products available, many of which now include downsizing protection or penalty-free withdrawal options.8

Check Before You Commit

Downsizing protection isn’t universal. Providers may impose restrictions on:

- Minimum residence period

- Reason for moving

- Specific terms within your contract

PRO TIP: Always review the Key Facts Illustration (KFI) and consult a qualified FCA-regulated adviser to confirm that your chosen plan includes this feature and understand any conditions.

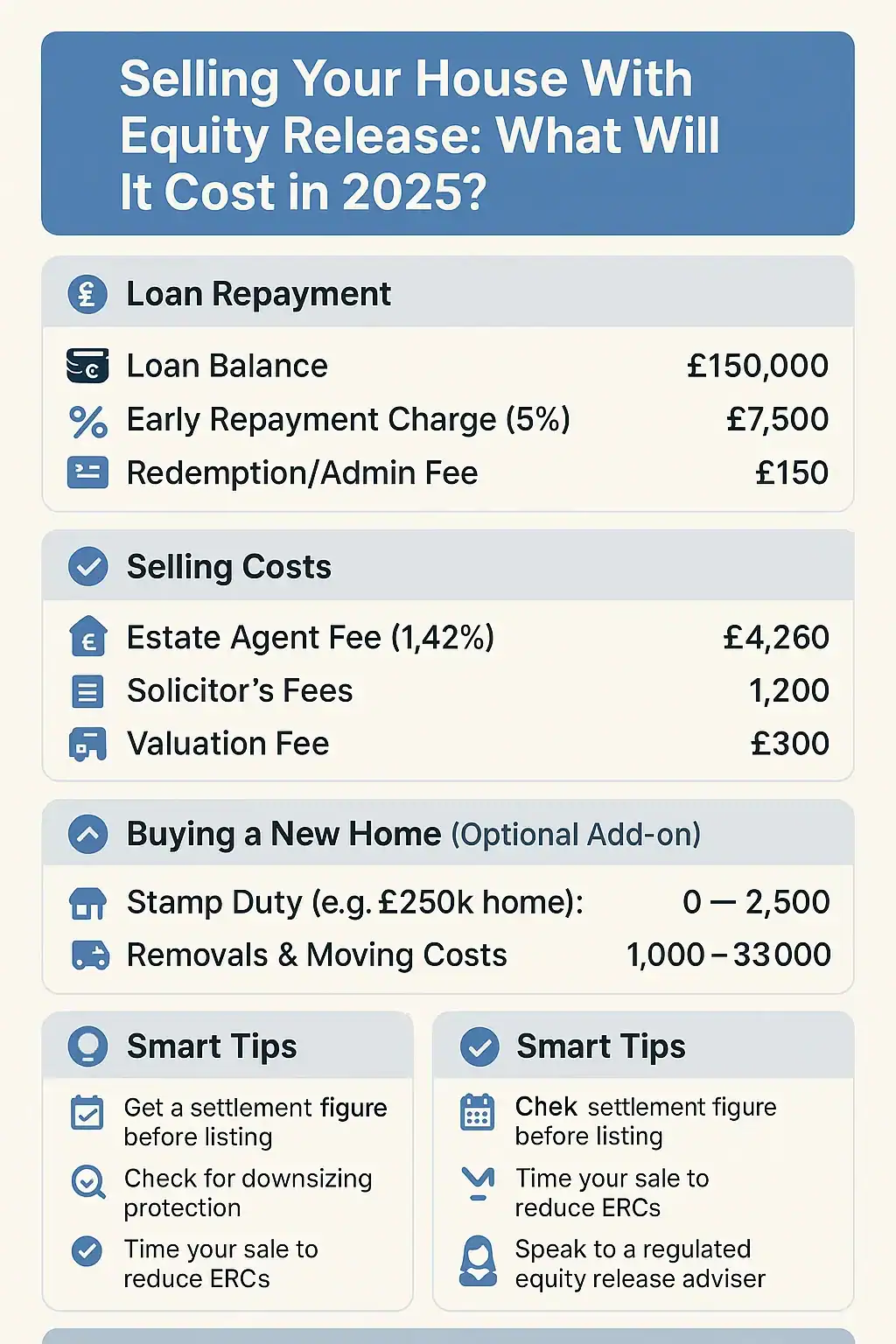

What Are the Costs and Fees of Selling With Equity Release?

Selling a property with an active equity release plan comes with a number of costs—some standard, and others specific to your loan agreement.

Understanding these charges in advance is essential to avoid unexpected deductions from your sale proceeds.

Key Costs to Expect

| Cost Type | Typical Range (UK) | Details |

|---|---|---|

| Early Repayment Charges (ERCs) | 0%–10% of loan balance | May apply if the loan is repaid early—unless downsizing protection applies. 9 |

| Redemption/Exit Fees | £100–£300+ | Admin fees charged by the lender to close the plan. |

| Estate Agent Fees | 0.9%–3.6% of sale price (avg. 1.42%) | Based on property value—e.g., ~£4,260 for a £300k home. |

| Solicitor’s Fees | £850–£2,000+ | Legal work to handle sale and loan repayment. |

| Valuation Fees | Sometimes included, or £200–£600+ | Paid if the lender requires updated property valuation. |

| Stamp Duty (on new home) | Varies by property price – e.g., 0%–5% in England and NI. | Applies if you’re buying a new home. |

| Moving Costs | £1,000–£3,000+ | Includes removals, storage, temporary accommodation. |

Example Breakdown for a £300,000 Sale

- Lifetime mortgage balance: £150,000

- ERC (5%): £7,500

- Redemption & legal fees: ~£2,000

- Estate agent (1.4%): £4,200

- Net proceeds after repayment & fees: ~£136,300 (before buying a new home)

Tips Before Selling:

- Always request a settlement figure from your provider before listing your home.

- Confirm if your plan includes downsizing protection or portability to minimise fees.

- Factor in the timing of the sale—some ERCs reduce or expire after a fixed term (e.g., 8 years).10

Always, speak to a qualified equity release adviser and property solicitor to receive tailored cost estimates based on your plan and location.

Selling With Equity Release Costs Infographic

What Housing Market Trends Affect Selling With Equity Release?

When planning to sell your home after taking out equity release, it’s crucial to understand how current property market trends may impact your sale.

Shifts in property prices, buyer demand, and lending conditions can all affect your timing, sale price, and whether porting your plan is even possible.

1. House Price Movements & Regional Differences

The latest ONS data (to March 2025) shows average UK house prices are up 6.4% year‑on‑year, with significant regional disparity — e.g., Northern Ireland +9.5%, the North East +14.3%, but London lagging at just +0.8%. 9

Why it’s critical: If you reside in an area with slow or negative price growth, the net sale proceeds may not fully cover your equity release debt — especially once compounded interest is considered. Equity release borrowers in northern regions might enjoy a buffer, while those in London or the South East face tighter margins.

2. Buyer Demand, Inventory Levels & Pricing Pressure

Rightmove reports new buyer demand is 3% higher than a year ago, while listings have surged ~11%, marking a decade-high choice for buyers. However, June 2025 saw a 0.3% drop in asking prices, largely in the South West, South East, and London — signalling an intensely competitive market. 10

Equity release impact: More listings mean sharper competition — meaning overpricing can lead to stalled sales. If time is short, you may need to price slightly below market value to ensure the sale covers your equity release balance.

3. Interest Rates, Lending Costs & Remortgage Options

The Bank of England base rate has remained at 4.25%, which has kept mortgage and equity release costs elevated. While fixed mortgage rates have softened, they hover near 4–5%, limiting affordability and reducing competition among buyers.11

Practical Tips: With funding costs high, retaining your current equity release may be cheaper than switching. If you’re planning to move, speak to your provider or adviser about options like downsizing protection or porting, and calculate whether a new loan yields genuine savings once fees and compounded interest are factored in.

4. Timing & Strategic Planning

House‑sale volumes hit a four‑year high in May 2025 (+6% year‑on‑year), boosted by buyers rushing before stamp‑duty changes expired. Historically, spring and early autumn remain the strongest seasons for selling.12

Strategy tip: Coordinate your sale in alignment with these peak periods. Also build flexibility into your schedule — delays in the chain could affect the timing for repaying or porting your equity release plan.

Common Questions About Selling a Property With Equity Release

Notify your equity release provider of your intent to sell. They will issue a redemption statement detailing the amount owed, including interest. Instruct a solicitor to manage the sale and settle the loan from the proceeds.

It’s essential to consult a qualified financial adviser to evaluate tax implications, potential early repayment charges, and whether porting is viable.

Yes, but the loan and accrued interest must be repaid from the sale. Porting may be an option if the new property qualifies. If not, and your plan includes downsizing protection, early repayment charges may be waived.

Yes, if your plan allows it and the new property meets your lender’s criteria. If not, the loan must be repaid—unless downsizing protection applies. Always confirm terms with your provider.

Yes, with a lifetime mortgage, you remain the legal owner. With a home reversion plan, the provider owns a share—or all—of your property.

It depends on your financial goals. Selling may offer flexibility or equity access, but could trigger fees. Get independent advice before deciding.

No, full letting is usually not allowed. Some plans may permit a lodger, subject to lender approval. Always check your provider’s policy.

Yes, any remaining equity after repaying the loan and interest is yours to keep. The amount depends on your home’s value, how long the plan has run, and the interest rate.

If your plan includes a No Negative Equity Guarantee, you or your estate won’t owe more than the sale price. The provider absorbs the shortfall.

Yes, it’s recommended. A solicitor experienced in equity release ensures compliance, handles lender requirements, and helps avoid costly delays.

Conclusion

Selling a house with equity release offers potential financial benefits but comes with its own set of complexities and risks.

That's why for those over 65, you first need to answer, is equity release worth considering for financial flexibility, before taking out an equity release plan.

It is crucial to explore all available options, from porting your existing plan to seeking downsizing protection, to fully understand the costs and implications involved.

Consulting with a financial advisor is indispensable in this process.

Ultimately, to release equity from house can provide substantial financial flexibility when navigated thoughtfully and with the right professional guidance.

Seeking equity release advice from a qualified professional ensures that you receive personalized recommendations aligned with your financial goals.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

Found an Error? Please report it here.

100% private. No pressure. Just friendly guidance.

100% private. No pressure. Just friendly guidance.