Where to Find the Best Equity Release Options in 2025: Don’t Miss Out!

Be aware. Equity release comes with drawbacks which are important to think about. Lifetime mortgages are secured loans. Compound interest means the amount you owe can grow quickly. Equity release reduces your estate's value and may impact means-tested benefits.

Be aware. Equity release comes with drawbacks which are important to think about. Lifetime mortgages are secured loans. Compound interest means the amount you owe can grow quickly. Equity release reduces your estate's value and may impact means-tested benefits.Key Takeaways:

- Discover nearby equity release providers with online searches, financial comparison sites, or local directories, and use geo-specific online search tools to pinpoint options close to you.

- Connect with local financial advisers to tap into their network of equity release companies and utilise online comparison platforms to assess and choose the best equity release scheme for your situation and circumstances.

- Evaluate local options by comparing interest rates, plan flexibility, and customer feedback.

Searching for "equity release near me" may seem like a good place to start, but what do those results really mean?

Finding the right plan isn’t just about unlocking cash from your home—it’s about working with trusted local experts who understand your financial targets and milestones.

At EveryInvestor, we provide you with the resources and guidance to help you connect with certified professionals.

Whether it’s exploring the Equity Release Council’s list of approved advisers or discovering local seminars and workshops, our expert insights ensure you’re making informed decisions.

Keep reading to secure the best deal near you...

What Is Equity Release, and How Does It Work?

Equity release is a financial strategy that works by allowing homeowners aged 55 and above to unlock the financial value tied up in their property without having to sell it—a practical option for boosting retirement income, particularly if other savings are limited.

While equity release provides financial flexibility, it’s crucial to consider the impact on your estate and inheritance, which is why seeking independent equity release advice is essential before proceeding to ensure you fully understand the long-term implications.

What Are the Main Equity Release Options and Their Benefits?

The two main equity release types are lifetime mortgages and home reversion plans, each offering different benefits depending on the homeowner’s needs.

A lifetime mortgage is the most popular option.1

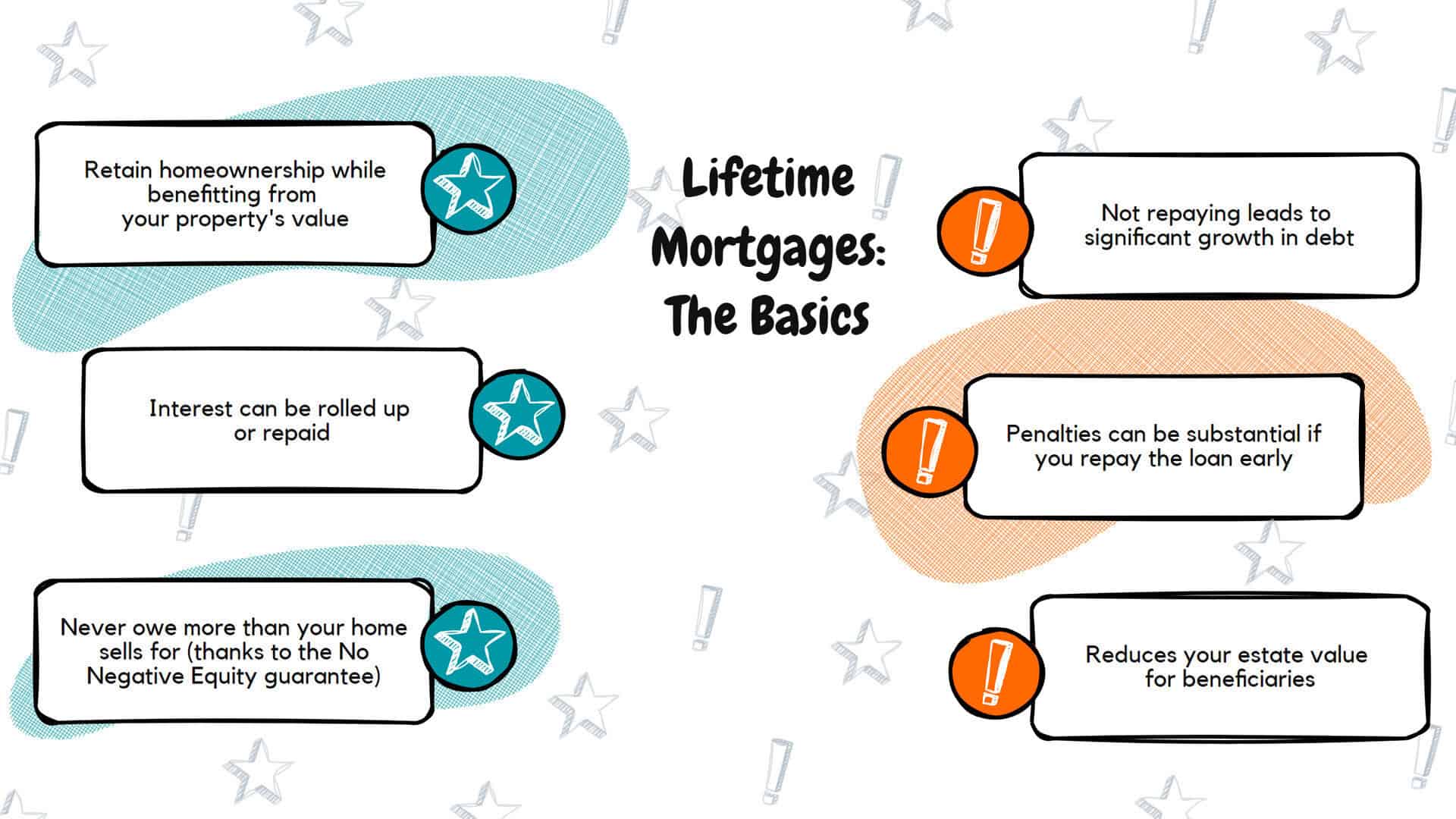

What to know about lifetime mortgages:

- A lifetime mortgage allows homeowners aged 55 or over to borrow money secured against their home while retaining full ownership.

- Interest can be rolled up or paid off in part, and the loan is repaid when the homeowner dies or moves into long-term care.

- Benefits include flexibility in how funds are released (lump sum or drawdown), no need to move house, and a No Negative Equity guarantee with regulated plans.

Drawbacks of lifetime mortgages:

- They work with compound interest, which means that if interest is not repaid, it accumulates over time, significantly increasing the total amount owed.

- Paying off the loan early can incur substantial Early Repayment Charges.

- Borrowing against your home reduces the value of your estate passed on to beneficiaries.

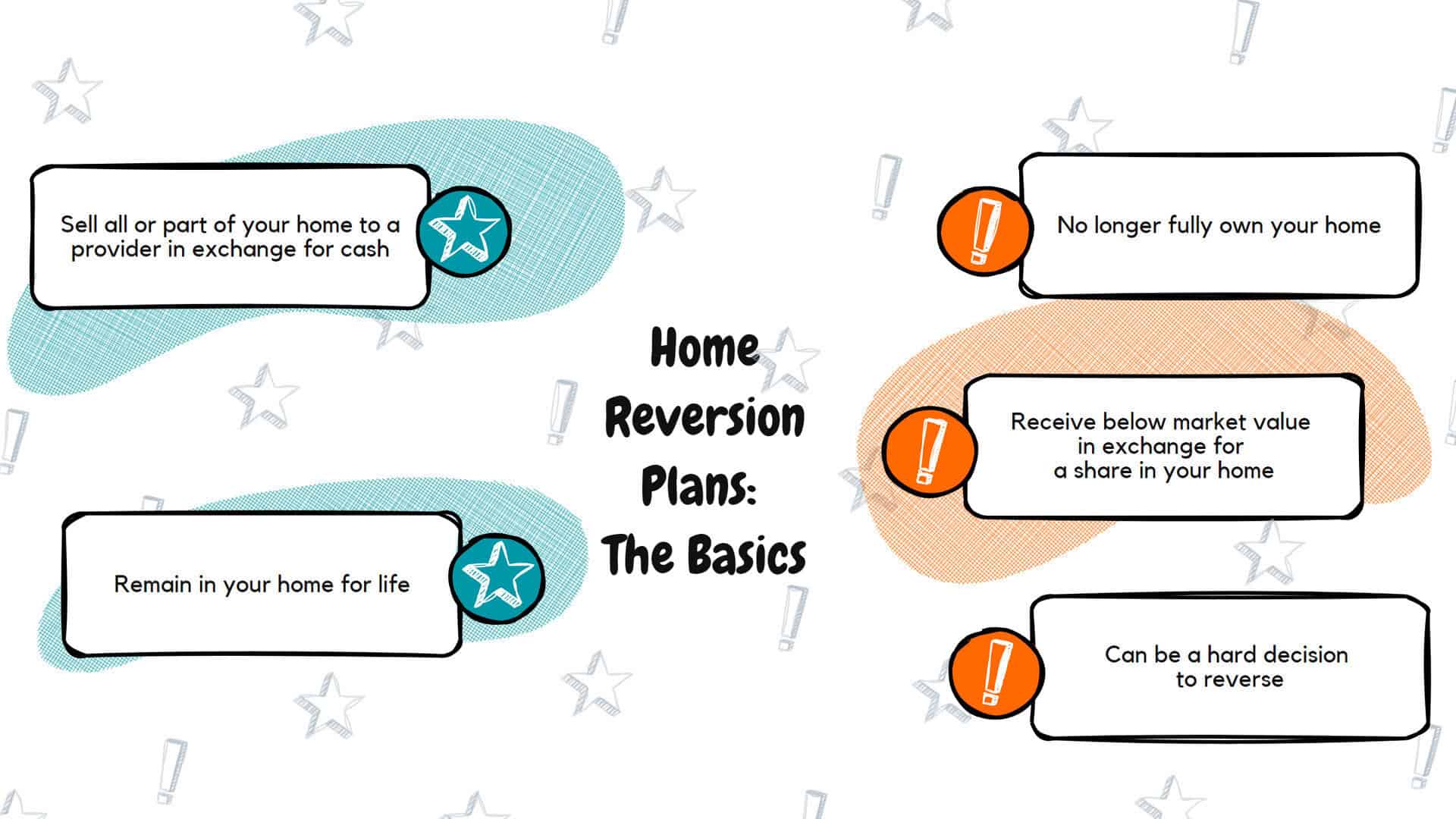

What to know about home reversion plans:

- A home reversion plan, available from age 60, involves selling part or all of your home to a provider in exchange for cash.

- You stay in your home for life, but you no longer fully own it.

Drawbacks of home reversion plans:

- You sell part or all of your home, meaning you no longer fully own the property.

- The amount received for the share sold is usually below market value.

- It’s harder to reverse the decision or move home than it would be with a lifetime mortgage.

Both options can free up funds for retirement, but professional advice is strongly recommended to understand which suits your personal and financial circumstances best.

How Does Equity Release Vary by Location?

Equity release in the UK varies significantly by region owing to factors like house prices and local economic conditions.

Research published in the International Real Estate Review in 2024 suggests that southern, wealthier areas tend to have greater access to equity release mortgages and higher uptake rates, but borrowers in these regions often require lower loan-to-value (LTV) ratios.2

Key regional differences include:

- Higher demand in affluent areas: Homeowners in London and the South East are more likely to use equity release due to higher property values, allowing them to unlock more capital.

- Lower LTV ratios in wealthier regions: Borrowers in southern England typically take out lower LTV loans, meaning they borrow a smaller percentage of their home’s value.

- Economic factors influencing uptake: In regions with lower pension income and higher living costs, such as parts of Northern England and Scotland, equity release may be used more frequently to supplement retirement income.

- House price growth impact: Areas with strong house price appreciation see more equity release activity, as homeowners can access larger sums.

A quick illustration

In high-demand areas like Birmingham, you may find more favourable options, while regions like Northern Ireland could present different availability and terms owing to local market conditions.

Speaking to local advisers is essential for understanding these differences.

Let's look at top locations and property values:

Is Equity Release Better in Major Cities or Rural Areas?

Equity release may be better in major cities, but the best option depends on individual circumstances.

How equity release may differ:

| Major Cities | Rural Areas | |

|---|---|---|

| Property Values | Urban areas like London, Birmingham, and Manchester tend to have higher house prices, allowing homeowners to unlock more equity. | Homes in rural regions may have less equity to release, limiting borrowing potential. |

| Lender Availability | More financial institutions operate in cities, offering competitive rates and flexible plans. | Some providers may be less willing to offer equity release in remote areas because of the lower resale value. |

| Access to Advisors | Cities have more equity release specialists, making it easier to get tailored advice. | It may be more of a challenge to find a local advisor in a rural area. |

| Eligibility Criteria | City homes may meet lenders' eligibility criteria more easily than rural homes. | Rural properties, especially farms or non-standard homes, may struggle to meet strict eligibility criteria. |

| Demand | Demand may be higher. Because of rising living costs, retirees in cities may use equity release to supplement their income. | Homeowners in rural areas may need less financial support owing to lower living costs. |

Urban properties often appreciate faster due to high demand, which can increase the amount you can release; however, in rural areas, although property values might be lower, the lower cost of living and potentially less debt could make equity release a viable option to cover retirement expenses or home improvements.

Advisers who are well-versed in local market conditions can offer invaluable insights and guidance.

What Are the Top Locations for Equity Release?

The top locations for equity release tend to be areas with higher property values, though recent research by the Equity Release Council has debunked the belief that this kind of borrowing is chiefly clustered in London and the South East.4

Based on ERC figures, regions that saw the highest growth in equity release lending between 2014 and 2023 include:

- Wales

- the East Midlands

- the East of England

Read about equity release by nation here:

Where Can You Find the Best Equity Release Providers Near You?

To find the best best equity release providers near you, you can search both offline and online.

When using search engines or financial comparison websites, entering terms like "equity release providers near me" will help you locate local businesses and advisers online.

Offline, you can also consult local directories or ask for recommendations from financial advisers and mortgage brokers in your area.

Here's how you can find the best equity release companies:

How Can You Find Reputable Equity Release Advisers Near You?

To find reputable equity release advisers near you, look for professionals accredited by recognised organisations like the Equity Release Council.

You can also rely on recommendations from friends or family, check online reviews, or use directories of certified advisers.

Ensure the adviser offers unbiased equity release advice and has access to a broad range of equity release products.

How Do You Verify an Equity Release Adviser’s Credentials?

You can verify an equity release adviser's credentials by checking if they are registered with the Financial Conduct Authority (FCA), which ensures they adhere to strict rules and regulations.

To check if an advisor is a member of the Equity Release Council, find them on the Council's register.5

Criteria for Choosing the Best Equity Release Adviser

When choosing the best equity release adviser, consider their qualifications and accreditations, as well as their range of products, as this ensures they can recommend the best solution for your needs.

Other important criteria include transparent fees, positive client testimonials, and a tailored approach that aligns with you and your situation, as these reflect the adviser’s reliability and customer-centric skills.

Why Is Local Knowledge Important When Choosing Equity Release?

Local knowledge when choosing equity release is important because regional variations can significantly impact the terms and benefits of the schemes available to you.

Advisers with specific local expertise are aware of market trends and legal considerations unique to your area, which can influence the availability of products and the overall cost of borrowing.

This knowledge ensures that the advice you receive is compliant with national standards and optimised for your local real estate market conditions, potentially enhancing the value and suitability of your equity release plan.

How Can You Book a Free Consultation with Local Equity Release Advisers?

Booking a free consultation with local equity release advisers can be straightforward; start by visiting websites of accredited financial advisory firms specialising in equity release, as these often offer an initial free consultation as part of their service to help you understand your options without any commitment.

You can also look for local seminars on retirement planning and equity release, which frequently provide opportunities for free consultations.

Moreover, checking platforms like the ERC can direct you to certified advisers in your region who offer free initial assessments to discuss your specific needs and circumstances.

What Are the Best Equity Release Options Available in 2025?

The best equity release options available in 2025 depend on individual circumstances, but top products often include plans with a level of flexibility.

Let's take a look at your options:

The top equity release plans for 2025 include lifetime mortgages, enhanced lifetime mortgages, and drawdown lifetime mortgages; each plan offers unique and tailored features, allowing homeowners to access their property's equity with flexibility and security.

Equity release providers in the UK are introducing more flexible features to improve their plans and make them more appealing to homeowners.

Some key enhancements include:

- Voluntary repayments: Borrowers can now make partial repayments to reduce the overall interest accumulation, helping to preserve more equity in their property.

- Tapered early repayment charges: Some plans now offer fixed penalty structures where the penalty tapers off over time, making it easier for homeowners to exit their equity release plan without unexpected costs.3

- Drawdown facilities: Instead of taking a lump sum, borrowers can access funds gradually, reducing interest charges over time.

- Interest-only lifetime mortgages: These products allow homeowners to pay off interest monthly, preventing the loan from growing significantly over time.

- Inheritance protection: Some plans now include guaranteed inheritance options, ensuring a portion of the property’s value is preserved for beneficiaries.

Before thinking about the different plans available to you, however, there are some important things to discuss with your advisor.

Essential Questions to Ask Local Equity Release Advisers

Essential questions to ask local equity release advisers before thinking about your ideal plan include those about

Here are some essential questions to consider:

- Eligibility & Suitability: Understand the age, property value, and financial criteria. Are there better alternatives to equity release?Explore options like downsizing or remortgaging.

- Costs & Fees: What are the total costs involved? Ask about arrangement fees, interest rates, and legal costs. How will interest accumulate over time? Understand how compound interest affects the loan.

- Impact on Finances & Inheritance: How will equity release affect my benefits and taxes? Some plans may impact state benefits. What happens to my home when I pass away or move into care? Clarify inheritance implications.

- Plan Flexibility: Can I make voluntary repayments? Some plans allow partial repayments to reduce interest. Are there early repayment charges? Check if penalties apply for repaying the loan early.

Common Questions on Equity Release Near You

To find equity release providers near you, you can start by conducting a search online using keywords like “equity release providers near me” or “equity release companies in my area.”

This will help you locate local providers who offer equity release schemes specifically tailored for your part of the United Kingdom.

Additionally, you can seek recommendations from friends, family, or colleagues who may have already used equity release services in your area.

If you’re looking to locate an equity release scheme near you, there are several ways to go about it.

Firstly, you can use online directories or search engines by typing in phrases like “equity release schemes near me” or “equity release plans in my area.” This will help you find a list of providers who offer such schemes in the United Kingdom.

Additionally, you can seek guidance from independent financial advisers who specialise in equity release to explore various options available to you locally.

Yes, there are several equity release companies available in various regions of the United Kingdom.

To find equity release companies near you, you can search online using search engines or online directories. Type in relevant keywords like “equity release companies near me” or “local equity release providers.”

This will provide you with a list of companies operating in your area. It’s important to research and compare these companies before making any decisions, ensuring they are reputable and regulated by the necessary financial authorities.

When considering equity release options near you, it’s crucial to understand that the “best” option will vary depending on your individual circumstances and needs.

To find the most suitable equity release option for you, seek advice from independent financial advisers who specialise in equity release. They can assess your situation and guide you towards the options that align with your goals and preferences.

It’s essential to consider factors such as interest rates, repayment options, and associated fees when evaluating the different choices available.

To compare equity release plans near you, start by researching and shortlisting reputable providers in your area.

Then, request detailed information on their plans, including interest rates, repayment options, and any associated fees. Evaluate the terms and conditions of each plan carefully, considering the impact on your finances and long-term goals.

It’s advisable to consult with independent financial advisers who can provide expert insights and help you make an informed decision. Remember, comparing plans will help you find the one that best suits your unique circumstances and requirements.

Final Thoughts About Finding Local Equity Release Options

Using online tools, getting recommendations from friends and family, and consulting trusted local publications can help narrow down your search for local equity release options.

For personalised advice, consult a local advisor who understands the equity release landscape in your area and can guide you through the process.

With the right support and local insights, you’ll find an equity release option that enhances your financial freedom while safeguarding your estate for the future.

Discovering the best equity release near you in 2025 requires careful research and smart planning, and by comparing local lenders, their terms, and client reviews, you’ll get a clearer picture of your best options.

Found an Error? Please report it here.

100% private. No pressure. Just friendly guidance.

100% private. No pressure. Just friendly guidance.