Age Partnership Equity Release (2025): An Expert Review

Be aware. Equity release comes with drawbacks which are important to think about. Lifetime mortgages are secured loans. Compound interest means the amount you owe can grow quickly. Equity release reduces your estate's value and may impact means-tested benefits.

Be aware. Equity release comes with drawbacks which are important to think about. Lifetime mortgages are secured loans. Compound interest means the amount you owe can grow quickly. Equity release reduces your estate's value and may impact means-tested benefits.Key Takeaways

- Age Partnership is a Financial Conduct Authority (FCA)-regulated equity release advisor in the UK, specialising in later-life financial services for individuals aged 55 and over. Their services include equity release, retirement mortgages, pensions, insurance, and lasting power of attorney arrangements.

- The firm offers independent equity release advice from a panel of leading lenders, including Aviva, Canada Life, Pure Retirement, and Just, allowing clients to compare multiple options before selecting a product that meets their needs.

- Age Partnership has received several industry awards, including Equity Release Broker of the Year at the 2025 Mortgage Awards, and holds the Investor in Customers Gold Award for excellence in client satisfaction.1

- Initial consultations are free of charge, with a £1,895 advice fee only payable if the client proceeds with a recommended plan and the case completes.

- Clients benefit from Age Partnership’s service commitment, which includes a dedicated advisor, whole-of-market plan comparison, and adherence to Equity Release Council standards, such as the No Negative Equity guarantee and the right to remain in the property for life.

Equity release remains a key financial tool for homeowners over 55 in the UK. Despite higher borrowing costs following the 2022 mini-budget, over £2.3 billion was unlocked through equity release in 2024, demonstrating continued demand for later-life lending solutions.2

This 2025 review examines Age Partnership, one of the UK’s most prominent equity release advisors, focusing on their service model, fees, lender partnerships, and customer feedback. The aim is to help you determine whether Age Partnership aligns with your financial goals in retirement.

In This Article, You Will Discover:

The EveryInvestor editorial team, composed of regulated financial writers and retirement lending analysts, reviews the sector regularly and applies strict quality control measures to ensure factual accuracy.

Let’s explore whether Age Partnership could be the right advisory firm for your equity release needs.

NOTE: EveryInvestor is an impartial and unconnected third-party information provider via this website, and the details replicated in this commentary represent the opinions of EveryInvestor only and may not reflect the views or opinions of Age Partnership. This article must not be interpreted as advice, nor is it a solicitation to conduct transactions in any financial product provided by Age Partnership.

What Is Equity Release and How Does It Work?

Equity release refers to a set of financial products that allow homeowners aged 55 and over to access the value tied up in their residential property, without needing to move out or sell it. These products are typically used to supplement retirement income, fund home improvements, or provide financial support to family members.

The funds released are untaxed and can be taken as a lump sum, a series of payments (known as drawdown), or a combination of both.

The two main types of equity release are:

- Lifetime mortgages (the most common type)

- Home reversion plans

These products are regulated by the Financial Conduct Authority (FCA) and, when advised through members of the Equity Release Council (ERC), offer consumer protections such as the No Negative Equity guarantee and the right to remain in your home for life.3

What Are the Main Types of Equity Release?

Lifetime Mortgages

A lifetime mortgage is a loan secured against your home that does not require monthly repayments. Instead, the loan plus any accrued interest is typically repaid when the last homeowner dies or moves into long-term care, and the property is sold.

Key features:

- Available from age 55 (though loan amounts usually increase with age).

- You retain full ownership of your home.

- Some plans allow voluntary repayments or interest servicing to reduce the final debt.

- Interest is compounded if left unpaid.

- Significant early repayment charges may apply if you settle the loan early.

Lifetime mortgages account for the vast majority of equity release activity in the UK. Lifetime mortgages account for over 99% of equity release activity in the UK, according to the Equity Release Council’s Q1 2025 bulletin.4

Home Reversion Plans

A home reversion plan allows you to sell a portion (or all) of your home to a provider in exchange for cash, while retaining the right to live in the property for life.

How it works:

- Typically available from age 60 or older.

- You agree to sell a fixed percentage of your property’s value.

- The provider pays below market value, usually 20% to 60% of the property’s actual worth, to compensate for the lifetime occupancy right.

- No repayments are required.

- When the property is sold (after your death or when you move into care), the provider receives their share of the sale proceeds according to the percentage sold to them when you entered into the contract.

Home reversion plans are rarely used today and account for well under 1% of new equity release activity, according to the Equity Release Council.5

They may be suitable for some clients who don't need to retain the full value of their home for inheritance purposes.6

Professional advice is essential when considering either option, as both involve long-term financial commitments and can affect entitlements to means-tested benefits or future borrowing.

Who Are Age Partnership and What Do They Offer?

Age Partnership is a UK-based retirement finance specialist, authorised and regulated by the Financial Conduct Authority (FCA). The firm has been providing equity release and later-life financial advice since its establishment in 2004 and is headquartered in Leeds, West Yorkshire.

Age Partnership supports clients across the UK considering later-life mortgages, pension income, lasting power of attorney, and home insurance.7

What Services Does Age Partnership Provide?

Age Partnership offers a wide range of services.

These services include:

- Equity Release Advice: Age Partnership provides advice on lifetime mortgages and home reversion plans.8

- Mortgages: The firm advises on mortgages for the over-50s (including Retirement Interest-Only and later-life repayment mortgages9) and for borrowers at earlier stages of life (including first-time buyers10).

- Pension Income Guidance: Age Partnership advises on lifetime and fixed annuities and drawdown and cash withdrawal options.11

- Insurance: Age Partnership can arrange home insurance (administered by Cavere and underwritten by Integra Insurance Solutions Ltd).12

- Legal Arrangements: Age Partnership can set up your lasting power of attorney (LPA).13

These services are delivered with support from trained advisors who assess personal financial circumstances before making any recommendations.

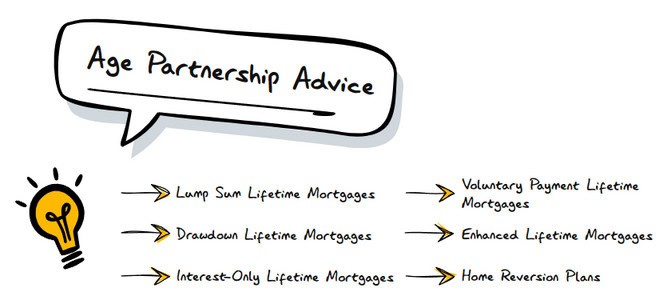

What Equity Release Plans Does Age Partnership Offer?

As a whole-of-market broker, Age Partnership provides advice on equity release products from a panel of leading UK providers including Aviva, Canada Life, Just, and Pure Retirement. This approach enables clients to compare features, rates, and criteria across multiple plans.

Their portfolio includes:

- Lump Sum Lifetime Mortgage: A single tax-free cash release secured against the property.

- Drawdown Lifetime Mortgage: Flexible access to funds over time, with interest only accruing on what is withdrawn.

- Interest-Only Lifetime Mortgage: Allows regular interest payments to limit debt build-up.

- Voluntary Payment Lifetime Mortgage: Enables partial repayments without penalties.

- Enhanced Lifetime Mortgage: For those with certain health conditions that allow for higher borrowing.

- Home Reversion Plan: Selling a share of the home to a provider in exchange for a lump sum.

The firm adheres to Equity Release Council standards, ensuring clients benefit from features like the No Negative Equity guarantee, the right to remain in their home for life, and receiving mandatory legal advice.

Why Choose Age Partnership for Equity Release Advice?

Choosing the right equity release advisor is critical to ensuring you receive appropriate financial guidance, product transparency, and long-term protection. Age Partnership has established itself as a leading provider in the UK equity release sector for several reasons, including its award-winning service, regulatory standards, and strong partnerships with top lenders.

Industry Recognition

Age Partnership has been recognised consistently by the UK financial services industry for excellence in later-life financial advice.

Notable awards include:

- Equity Release Broker of the Year at the 2024 Mortgage Awards14

- Later-Life Adviser of the Year (Hayley Larham) at the 2023 Women's Recognition Awards15

- Investor in Customers Gold Award (2023), reflecting high customer satisfaction scores16

- Investors in People Standard Accreditation17

- Best Financial Adviser – 20+ Advisers at the 2022 Equity Release Awards18

- Best Broker for Equity Release at the 2019 Mortgage Strategy Awards19

These awards recognise key metrics such as client satisfaction, training, regulatory compliance, and innovation in service delivery.

The Investor in Customers Gold Award, in particular, evaluates firms against core customer service benchmarks, including how well they understand, meet, and exceed customer expectations.20

Service Promise

Age Partnership outlines a clear Service Promise designed to reassure clients and maintain regulatory best practice.

This includes:

- Assigning a dedicated financial advisor to each client throughout the equity release journey

- Only recommending equity release if it is suitable and in the client’s best interest

- Comparing products from multiple lenders to ensure competitive terms and flexibility

- Ensuring that all recommended plans meet Equity Release Council standards, such as including the No Negative Equity guarantee

- Providing a written recommendation report, allowing clients to review advice at their own pace before proceeding

This approach supports informed decision-making and helps clients avoid mis-selling risks, a key focus of the Financial Conduct Authority (FCA).

Strategic Lending Partnerships

Age Partnership works with several of the UK’s top equity release providers, ensuring access to a broad range of plan features, underwriting criteria, and interest rate structures.

Their panel includes:

This panel-based model enables Age Partnership to tailor solutions to individual needs, including those with medical conditions, inheritance goals, or preferences around repayment flexibility.21

How Much Does Age Partnership Charge in 2025?

Age Partnership’s Advice Fee

Age Partnership charges a £1,895 advice fee, but this is only payable upon completion of an equity release plan. The firm does not charge for the initial consultation, which allows clients to explore their options with no financial obligation.

As part of the advice process, clients receive:

- A one-to-one consultation with a qualified equity release advisor

- A personalised recommendation report

- Comparisons across a panel of lenders, including Aviva, Just, Pure Retirement, and others

- Access to customer support throughout the application process22

Additional Costs to Consider

In addition to Age Partnership’s fee, clients may incur several third-party costs depending on the lender and legal requirements.

These can include:

- Property Valuation Fees: Some lenders offer free valuations; others may charge based on property type and location.

- Lender Arrangement Fees: Sometimes added to the loan or deducted from the cash released.

- Solicitor Fees: Legal advice is required by law and typically costs between £600 and £1,500.23

- Disbursements and Admin Charges: These may include land registry fees or identity verification costs.

All applicable fees are disclosed before you agree to proceed, in line with Financial Conduct Authority (FCA) requirements.24

What Interest Rates Does Age Partnership Recommend?

Understanding the interest rates available through Age Partnership is essential when evaluating the long-term cost of an equity release plan.

How Interest Rates Are Determined

Interest rates on equity release plans are typically fixed for life, though drawdown lifetime mortgages may charge a new prevailing rate on each drawdown.

The rate you’re offered depends on several factors:

- Your age and health status

- The loan-to-value (LTV) ratio

- The type of plan (lump sum, drawdown, interest-serviced, etc.)

- Any optional features, such as inheritance protection or early repayment flexibility

Age Partnership reviews all of these variables when sourcing quotes, helping clients secure the most competitive rate for their situation.

Average Equity Release Interest Rates in 2025

According to the Equity Release Council’s 2024 Market Report, average APRs for new lifetime mortgage products reached a year-low of 6.31% in September 2024, down from over 7% in 2023.25

While these figures serve as a national benchmark, the actual rate you are offered can differ significantly.

All interest rate quotes provided by Age Partnership include a detailed breakdown of terms, fees, and repayment options to ensure full transparency.

*While we regularly review our rates, these may have changed since our last update.

Are You Eligible for Equity Release Through Age Partnership?

Age Partnership follows standard eligibility criteria set by equity release lenders and the Equity Release Council.

These criteria are designed to ensure suitability and legal compliance.

Basic Eligibility Requirements

To qualify for an equity release plan via Age Partnership, you must generally meet a number of conditions.

You usually need to:

- Be aged 55 or over (both applicants, if applying jointly)

- Own a residential property in the UK

- Use the property as your main residence

- Have a property valued at £70,000 or more

- Be able to release enough equity to repay your existing mortgage

- Have no more than two individuals named on the property title

Additional Lender Conditions

Some lenders may impose further restrictions based on:

- Property type or construction materials

- Leasehold vs freehold status

- Location and postcode

- Minimum property size or floor area

Before proceeding, Age Partnership will conduct a full eligibility assessment to confirm whether equity release is suitable for your circumstances.

Can I Estimate My Equity Release With the Age Partnership Calculator?

Yes, Age Partnership offers an online equity release calculator that provides an instant estimate of how much equity you could unlock, based on your age and property value.26

The tool is useful for initial guidance but does not account for key factors such as your health, property type, or the specific terms available from lenders.

For a more accurate figure, request a personalised quote from an Age Partnership advisor.

What Are the Pros and Cons of Using Age Partnership?

Evaluating the advantages and limitations of working with Age Partnership can help determine whether they are the right advisor for your equity release journey.

Advantages of Using Age Partnership

- Whole-of-market access: Age Partnership compares plans from leading UK providers, including Aviva, Canada Life, Pure Retirement, and Just.

- Award-winning service: The firm has received multiple industry awards for equity release advice, including Equity Release Broker of the Year (2025).

- Dedicated advisor support: Each client is assigned a qualified advisor who provides one-to-one guidance throughout the process.

- No upfront fees: Initial advice is free. The £1,895 advice fee is only payable if a plan completes.

- Equity Release Council member: All recommended plans meet ERC standards, which means they include a No Negative Equity guarantee and the right to stay in your home for life.

- FCA-authorised and regulated: Clients benefit from consumer protections under UK financial services regulation.

Disadvantages and Considerations

The disadvantages of using Age Partnership for equity release correspond to those of opting for equity release in general.

Consider the following:

- Advice fee applies on completion: A fixed £1,895 fee is payable if you proceed with a recommended plan.

- Equity release impacts inheritance: Releasing funds reduces the value of your estate and may affect plans for leaving assets to loved ones.

- May affect benefits: Taking a lump sum or drawdown could reduce eligibility for means-tested state benefits.

- Long-term cost of borrowing: Interest rolls up over time unless you choose a repayment option, which can significantly increase your overall debt.

- Early repayment charges: Most plans include penalties for repaying the loan early, although all new lifetime mortgages approved by the Equity Release Council allow partial repayments up to a certain annual percentage without incurring penalties.

These disadvantages are common to equity release products generally, and Age Partnership helps clients assess whether this route is suitable before proceeding.

How Was This Age Partnership Review Conducted?

Our Review Process

This review was compiled by analysing publicly available data from independent sources, including regulatory bodies, customer feedback platforms, and product literature.

We evaluated Age Partnership based on:

- FCA registration and authorisation

- Membership of the Equity Release Council

- Breadth of lender panel and product range

- Fee transparency and service model

- Verified customer reviews and complaint trends

All facts and figures are current as of July 2025 and verified through official sources where available.

What Clients Say About Age Partnership

Age Partnership receives generally positive feedback from UK homeowners who have used their equity release advisory services.

Clients often cite:

- Clear and patient advice

- Responsiveness from advisors

- Confidence in the recommendation process

Current review scores from trusted platforms include:

- Trustpilot: 4.6 out of 5 (9,000+ reviews)

- Google Reviews: 4.2 out of 5 (300+ reviews)

- Review Centre: 4.3 out of 5 (75 reviews)

Note: Review scores are accurate at the time of writing and may change. Visit each platform for the latest data.

Common Complaints and How They’re Handled

While most feedback is positive, some clients have raised concerns.

The most common complaints include:

- Unexpected total costs: Some clients felt unprepared for additional legal or lender fees.

- Delays in processing: A few users noted that the equity release process took longer than anticipated.27

These issues highlight the importance of requesting a full fee breakdown and timeline estimate before proceeding.

Clients can raise concerns directly with Age Partnership’s compliance team:

- Email: enquiries@agepartnership.com

- Phone: 08080 555 222

- Post: The Compliance Officer, 2200 Century Way, Thorpe Park, Leeds LS15 8ZB

Who Regulates Age Partnership and How Are They Authorised?

FCA Regulation

Age Partnership Limited is authorised and regulated by the Financial Conduct Authority (FCA), the UK’s independent financial regulator. This means the firm must adhere to strict rules on consumer protection, transparency, and advice standards.

- FCA Firm Reference Number: 425432

- Company Registration Number: 05265969

- FCA Register Entry: View Age Partnership on the FCA Register

- Companies House Profile: View Age Partnership on Companies House

The FCA supervises activities such as mortgage advice, equity release advice, and credit broking to ensure clients receive fair and compliant treatment.

Permitted Services Under FCA Authorisation

According to the FCA register, Age Partnership is permitted to carry out certain activities.

These relate to:

- Insurance

- Mortgages & home finance

- Consumer credit

These permissions enable the firm to provide equity release advice alongside a broader range of later-life financial planning services.

Trading Names

Age Partnership operates under several trading names, including:

- Age Partnership

- Age Partnership Limited

- Age Partnership Plus

- Property Wealth

These names are all registered under the same FCA authorisation.

Equity Release Council Membership

In addition to FCA regulation, Age Partnership is a member of the Equity Release Council (ERC), the leading industry body for equity release providers and advisers in the UK.

As an ERC member, Age Partnership must comply with key product and advice standards.

These include:

- Recommending plans that include a No Negative Equity guarantee

- Recommending plans that include the right to remain in your home for life

- Informing clients of the mandatory independent legal advice requirement

ERC membership provides an additional layer of consumer protection and ensures that all recommended plans meet agreed standards.

How Can I Contact Age Partnership for More Information?

If you would like to speak with an advisor or request more information about equity release, Age Partnership can be contacted in a number of ways.

These include:

- Phone: 08080 555 222

- Email: enquiries@agepartnership.com

- Online: Request a Callback

- Post:

Age Partnership

2200 Century Way

Thorpe Park

Leeds LS15 8ZB

Their team is available to provide initial guidance with no obligation, and all consultations are handled by FCA-authorised advisors.

Common Questions Regarding Age Partnership Equity Release

Age Partnership offers equity release advice based on your age, property value, and financial goals.

After a free consultation, they recommend suitable plans from a panel of leading lenders.

If you proceed, the funds are released as a lump sum, drawdown facility, or both, with repayment typically occurring when you pass away or move into long-term care.

Yes. Age Partnership is FCA-regulated, a member of the Equity Release Council, and has won multiple industry awards for customer service and advice quality.

They offer access to plans from top UK lenders, tailored to individual client needs.

You can apply by contacting Age Partnership for a free consultation by phone, email, or online.

A qualified advisor will assess your circumstances, explain your options, and provide a personalised recommendation.

No fees are charged unless you choose to proceed with a plan.

Yes. Age Partnership is an official member of the Equity Release Council.

This means all their recommended plans meet strict consumer protection standards, including a no negative equity guarantee and the right to remain in your home for life.

Age Partnership charges a £1,895 advice fee, but only if you proceed and complete an equity release plan.

Initial consultations are free, and you’ll receive a personalised quote and recommendation before making any commitment.

Yes. Age Partnership is an independent equity release broker, not a lender.

They compare plans across a panel of leading providers, such as Aviva, Just, and Canada Life, to help clients choose the most suitable product.

Final Thoughts on Age Partnership Equity Release

Age Partnership has built a strong reputation in the UK equity release market through a combination of independent advice, access to a wide range of lenders, and adherence to regulatory and ethical standards. With a no-obligation consultation and a fee charged only upon completion, the firm provides a low-risk way to explore your options.

Whether you're seeking to unlock funds for retirement, support family, or improve your home, Age Partnership can help you compare plans, understand the long-term impact, and choose a solution tailored to your needs.

As with any financial decision, equity release should only be considered after receiving regulated advice and reviewing all alternatives, including downsizing, pension drawdown, or using other savings. Age Partnership offers the structure and experience to help you make that decision with confidence.

The features mentioned and the amounts raised, are subject to the lender’s criteria, terms and conditions. These may take into account the age, health and lifestyle factors in order to provide an enhanced amount. To understand the features and risks, ask for a personalised illustration.

Found an Error? Please report it here.

100% private. No pressure. Just friendly guidance.

100% private. No pressure. Just friendly guidance.