Is a SIPP a Good Idea? 6 Pros and Cons of a Self-Invested Personal Pension in 2025

See How Much Your Future Pension Income Could Be In Just 60 Seconds — No Fees, No Obligation.

How Much Could You Unlock?

Why Homeowners Trust Us

Try Our Free Pension Calculator

Quick, Safe Estimate

No Commitments

Key Takeaways

- Expansive Investment Universe: SIPPs enable you to invest in equities, ETFs, bonds, commercial property, and alternative assets beyond standard pension funds. That breadth grants autonomy—but comes with platform charges and requires informed decision-making.

- Tax-Efficient Retirement Growth: You receive upfront income tax relief at your highest marginal rate (20%–45%), tax-free compounding on returns, and a 25% tax-free lump sum from age 55 (57 from 2028). Additionally, SIPPs may offer inheritance tax advantages.

- Tailored Flexibility for Sophisticated Investors: Unlike rigid workplace pensions, SIPPs allow adjustable contributions, customizable strategies, and hands-on fund selection. They’re ideally suited for self-employed professionals, high-net-worth earners, or those seeking strategic oversight—provided you're comfortable steering your own portfolio.

Explore the full article to learn whether a SIPP aligns with your retirement goals and risk tolerance—especially if you're seeking more control and tax efficiency than traditional pensions can offer.

If you're a UK resident with a pension pot exceeding £50,000 and want greater control over how it’s invested—especially in equities, funds, or commercial property—a Self-Invested Personal Pension (SIPP) might be a better fit than traditional pensions.

The UK SIPP market now holds over £500 billion1 in assets, driven by investors seeking tax relief, investment flexibility, and long-term growth. But are SIPPs suitable for everyone?

EveryInvestor analysed data from over 10 leading UK SIPP providers, reviewed FCA pension guidance, and compiled real-world retirement scenarios to help you make an informed decision.

Our editorial process includes a compliance review against HMRC and FCA regulations, regular updates for legislative changes, and fact-checking by experienced financial writers.

In this article, we break down when a SIPP is the right move—based on your income bracket, risk tolerance, and how hands-on you want to be with your retirement strategy.

Disclaimer: The presented information is based on research and does not constitute financial advice.

What Is a SIPP and How Does It Work in the UK?

A Self-Invested Personal Pension (SIPP) is a UK government-approved personal pension scheme that gives you full control over how your retirement savings are invested.

Unlike traditional pensions with pre-selected funds, SIPPs let you choose from a wide range of investment options—including UK and global shares, ETFs, investment trusts, commercial property, bonds, and mutual funds.

You can manage your portfolio directly, use an adviser, or adopt a hybrid approach. SIPPs are best suited to individuals confident in managing investment risk or working with a regulated financial planner.

What Are the Top SIPP Benefits in 2025?

Opening a Self-Invested Personal Pension (SIPP) in 2025 can offer significant advantages over traditional pension schemes—especially for experienced or high-income investors.

Key benefits include:

Tax Relief on Contributions

The tax benefits of a SIPP, like those of other types of private pension, can help individuals boost their retirement savings.

Here are the key tax advantages:

- Tax Relief on Contributions: You receive tax relief at your marginal rate—20%, 40%, or 45%—on pension contributions up to £60,000 annually. Higher-rate taxpayers can claim additional relief via their self-assessment tax return.

- Tax-Free Growth: All investment gains within a SIPP are free from capital gains tax (CGT) and income tax until withdrawal.2

- 25% Tax-Free Lump Sum at Retirement: From age 55 (rising to 57 in 2028), you can usually withdraw up to 25% of your pension pot tax-free.3

- Inheritance Tax Benefits: Passing away before age 75 allows SIPP to be inherited tax-free; after age 75, beneficiaries pay marginal income tax on withdrawals.4

Remember, tax rules may change, and individual circumstances can vary.

Full Investment Control and Ownership

One of the main advantages of a SIPP is the ability to customise your entire pension portfolio based on your risk tolerance, financial goals, and investment knowledge.

With a SIPP, you can diversify across:

- UK and global shares

- Bonds and gilts

- Exchange-Traded Funds (ETFs)

- Investment trusts

- Mutual funds

- UK commercial property (including offices, warehouses, or retail units)

- Cash and fixed-income securities

This level of flexibility means you can adopt active or passive investment strategies, create tax-efficient asset allocations, or rebalance your portfolio in response to market changes.

However, this freedom comes with responsibility:

- Market volatility, poor diversification, or speculative investing could reduce your pension’s value.

- Regularly review performance, fees, and risk exposure to stay aligned with your retirement goals.

SIPPs are ideal for investors who want control, but not always suitable for those unfamiliar with financial markets.

Read On: Flexible Investment Options with Full SIPPs

Now Let's Look at Ownership...

A Self-Invested Personal Pension (SIPP) gives you direct ownership and control over your retirement investments—something most standard pension schemes don't offer.

Unlike workplace pensions, which typically restrict you to a limited set of pre-selected funds, SIPPs let you:

- Choose exactly where your money is invested

- React to market conditions with real-time trades

- Build a personalised portfolio around your goals and risk profile

Most SIPP providers offer online platforms with access to:

- Real-time market data and execution tools

- Performance dashboards

- Equity research and asset tracking features

From a legal perspective, your SIPP is a distinct trust-based structure—separate from your personal assets.

- Investments within the SIPP (e.g. shares, property) are typically held by the provider as trustee, although in some cases you may act as co-trustee.

- This legal separation ensures your pension assets are protected and used solely for retirement purposes, even in the event of insolvency or litigation.

This structure reinforces the SIPP’s value not just as a flexible investment tool—but also as a protected pension wrapper under UK law.

Potential for Higher Returns

SIPPs offer the potential for higher returns than standard pension schemes, primarily due to their investment flexibility and the ability to build custom portfolios.

Why SIPPs May Outperform

- Direct Access to High-Growth Assets: SIPPs let you invest in UK and global equities, small-cap stocks, ETFs, investment trusts, and commercial property—assets that can outperform passive funds in the long term.4

- Active Management Opportunities: You or your adviser can adjust your asset allocation in real time, rebalance for market changes, or pursue growth strategies.

- Compound Growth Over Time: With tax-free growth inside the pension wrapper, reinvested returns can compound faster compared to taxed investment accounts.

But Risks Still Apply

- Market Volatility: More asset choice means exposure to market downturns, sector-specific risks, or poor asset selection.

- Behavioural Risk: DIY investors may underperform due to emotional trading or overconfidence .

- Performance Not Guaranteed: Historical returns from equity-based SIPPs show a typical 5–8% annualised range over 10–15 years, but past performance is no guarantee of future results.5

According to AJ Bell, one of the UK’s major SIPP providers, diversified SIPP portfolios tend to outperform default workplace pension funds by 1–2% annually, especially among engaged, higher-risk investors .

How SIPP Tax Benefits Evolve After Age 65

After age 65, a SIPP offers significant tax advantages and flexibility that can optimise your retirement income strategy.

- Tax-Free Lump Sum: You can typically withdraw 25% of your pension pot as a Pension Commencement Lump Sum (PCLS) with no income tax liability.

- Tax-Efficient Drawdown: Remaining funds can be drawn flexibly, and taxed only at your marginal income tax rate—allowing control over your annual tax exposure.

- Inheritance Tax Benefits: If you die before age 75, any remaining SIPP funds can be passed to beneficiaries tax-free. After 75, withdrawals are taxed at the recipient’s income tax rate.

- Wealth Preservation: SIPPs aren’t counted as part of your estate for Inheritance Tax, making them an effective intergenerational wealth transfer tool.

These advantages make SIPPs especially valuable for high-net-worth individuals, early retirees, or anyone planning tax-efficient withdrawals in later life.

Who Should Use a SIPP for Retirement Savings?

SIPPs are ideal for UK investors who want hands-on control over how their pension is invested—and who are comfortable making their own financial decisions or working with an adviser.

A SIPP may be suitable if you:

- Have a pension pot of £50,000 or more and want to consolidate pensions.

- Want access to a broader range of investments (shares, ETFs, property).

- Are a higher-rate taxpayer seeking tax relief on contributions.

- Want to take a more active role in building your retirement portfolio.

SIPPs are less suitable for people who:

- Prefer professionally managed pension schemes (e.g. workplace or stakeholder pensions).

- Don’t have the time or knowledge to monitor investment performance.

- Are uncomfortable with market risk and portfolio volatility.

SIPPs offer freedom, but also demand responsibility. A financial adviser can help assess whether it’s the right structure for your goals.

So, Why Is UK Retirement Planning So Important?

The average retired couple in the UK needs between £22,400 and £59,000 per year to maintain a lifestyle ranging from ‘minimum’ to ‘comfortable’, according to the PLSA’s Retirement Living Standards.2

By contrast, the full new State Pension for 2025–26 is £230.25 per week—about £11,973 annually.3

Retirement planning helps you:

- Build Private Income using pensions, ISAs, and investments

- Harness Compound Growth by starting early

- Benefit from Pension Tax Relief on contributions

- Prepare for Major Expenses like healthcare, travel, and housing

Without a private pension—such as a SIPP—you risk relying primarily on savings or cutting back significantly in retirement. Planning ahead provides financial options, security, and peace-of-mind in later life.

What Should You Know Before Opening a UK SIPP?

Opening a Self-Invested Personal Pension (SIPP) gives you more control—but also more responsibility. Here are the most important things to consider before setting one up:

Eligibility & Contribution Limits

The eligibility criteria and contribution limits need to be considered when deciding whether opening a SIPP’s the right decision for you.

- Anyone between 18 to 75 with UK-relevant earnings can contribute to a SIPP and receive tax relief.

- SIPPs are open to UK residents and non-residents—depending on the latter's residency status and tax circumstances.10

- In 2025, the annual contribution limit is £60,000, though it may be lower if you’ve already started drawing income (the Money Purchase Annual Allowance is £10,000).6

- You can carry forward unused allowances from the past 3 tax years if eligible.

Costs and Charges

SIPPs usually come with platform fees (typically 0.2%–0.5% of assets), along with trading charges for buying and selling shares, mutual funds, or ETFs.

Additional admin fees may apply if you hold commercial property or non-standard investments .

These costs can compound over time, especially for active investors or those with lower balances—so always compare total cost across multiple providers.

Investment Risk & Volatility

You need an understanding of market risk and volatility and the long-term nature of retirement savings when opening a SIPP, so assess your investment time horizon, liquidity requirements, and capacity for loss in line with FCA suitability standards.

Here are some types of risk to look out for:

- Investment risk: The value of your investments can fall, leading to potential losses.

- Inflation risk: The growth of your SIPP may not keep pace with inflation, reducing the real value of your savings.

- Longevity risk: The risk of outliving your pension savings if you draw down too quickly or live longer than expected.

- Management risk: Inadequate diversification or suboptimal asset selection can materially impair portfolio performance and capital preservation.

- Regulatory risk: Changes to pension or tax laws can affect your SIPP.

- Cost risk: High fees can erode your pension savings over time.

- Scam risk: Be aware of pension scams and always deal with authorised providers.

Remember

The value of your investments can go down as well as up, and you may get back less than you invest.

Investment Knowledge & Expertise

SIPPs expose your retirement savings to market risk, inflation risk, and drawdown risk. Poor diversification, speculative investing, or emotional decision-making can all reduce your returns or lead to capital loss.

Furthermore, regulatory and tax changes—such as adjustments to the lifetime allowance, tax bands, or withdrawal rules—can alter your retirement outcomes .

Provider Risk & Protection

Provider risk refers to the possibility that the SIPP administrator or platform provider could collapse or suffer serious operational failure, potentially affecting your pension. This is separate from investment risk, which relates to the performance of your underlying assets.

Although the risk of a regulated SIPP provider failing is low, it's not zero. Understanding how SIPP provider risk works—and what protections you have—is essential for safeguarding your pension.

Here are a few things to consider about provider risk:

- Regulation by the FCA - All legitimate UK SIPP providers must be authorised and regulated by the Financial Conduct Authority (FCA). This ensures compliance with capital adequacy, client money rules, and conduct standards .

- FSCS Protection - If a provider fails, the Financial Services Compensation Scheme (FSCS) may cover losses up to £85,000 per person, per firm. This protection applies if the firm becomes insolvent—not if your investments lose value .

- No Cover for Investment Losses - The FSCS does not cover poor investment performance, market volatility, or fraud by third-party fund managers. You remain responsible for your investment decisions.

Researching a provider's stability, reputation, and regulatory status is crucial to mitigating provider risk.

Here are a few tipes to minimise the provider risk:

- Check the provider is FCA-authorised using the FCA Register.

- Review the provider’s financial stability, AUM (assets under management), and ownership structure.

- Prefer well-established SIPP operators with a long track record and clear client protections.

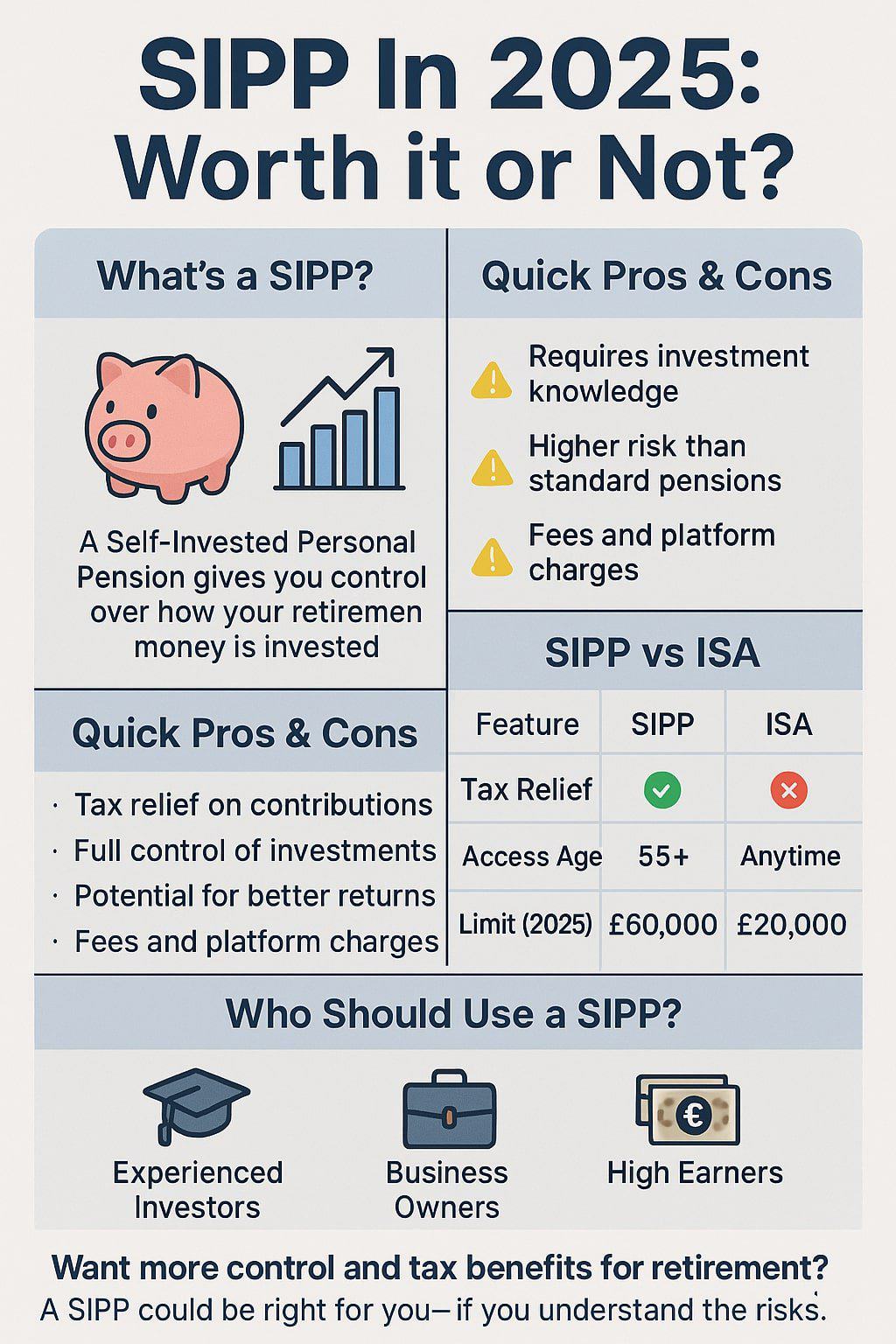

SIPP vs ISA: What’s Better for Retirement in 2025?

Both SIPPs and ISAs offer tax-efficient ways to save for the future—but they serve different purposes.

Choosing the right option depends on your income, retirement timeline, and how actively you want to manage your investments.

A SIPP offers more control and flexibility in investments, best suited for financially literate investors capable of executing informed investment decisions; by contrast, a professionally managed regular pension may suit those seeking a hands-off approach or lacking investment knowledge.

| Feature | SIPP (Self-Invested Personal Pension) | ISA (Individual Savings Account) |

|---|---|---|

| Primary Use | Long-term retirement savings with tax benefits | General-purpose tax-free saving and investing |

| Tax Relief on Contributions | ✅ Yes – at your marginal income tax rate (20%, 40%, or 45%) | ❌ No tax relief on contributions |

| Contribution Limits (2025/26) | Up to £60,000 annually (lower if MPAA applies) | Up to £20,000 annually across all ISAs |

| Tax on Investment Growth | ❌ None – investments grow free from income tax and capital gains tax | ❌ None – gains and income are tax-free |

| Withdrawal Rules | From age 55 (rising to 57 in 2028); 25% tax-free, remainder taxed as income | Anytime; 100% tax-free |

| Access Before 55/57 | ❌ Not permitted unless in cases of serious ill health | ✅ Fully flexible – withdraw anytime |

| Inheritance Tax Benefits | ✅ Can be passed on free of IHT if you die before 75 | ❌ Generally included in estate for IHT purposes |

| Investment Options | Wide range: equities, funds, bonds, ETFs, commercial property | Broad range: stocks, funds, ETFs (cash ISAs available too) |

| Regulation | Regulated by FCA; trustee oversight and tax rules via HMRC | Regulated by FCA |

| Best For | Higher earners, long-term retirement planning, tax-efficient drawdown | Flexible saving, mid-term goals, and tax-free access |

Use a SIPP if you're focused on building retirement income and want to take advantage of tax relief and long-term growth potential.

Use an ISA if you need liquidity, or if you’ve maxed out your pension allowances and want additional tax-free growth.

Many UK investors use both accounts strategically to optimise flexibility and tax efficiency across different time horizons.

Can You Buy Commercial Property Through a SIPP?

Yes—SIPPs allow you to buy commercial property as part of your pension portfolio. It’s a popular strategy among business owners and experienced investors seeking long-term, tax-efficient growth.

You can use a SIPP to invest in:

- Offices, warehouses, industrial units

- Retail premises (excluding residential spaces)

- Land or development sites (with restrictions)

- Your own business premises (via sale and leaseback arrangements)

📌 Residential property is not allowed in SIPPs and can result in severe tax penalties.

How SIPP Commercial Property Investment Works

If you're considering using your SIPP to buy commercial property, it's important to understand the rules, tax treatment, and operational responsibilities.

Here’s a breakdown of the key features and limitations:

| Aspect | Details |

|---|---|

| Eligible Property Types | Offices, retail units, industrial premises, land (if commercial use) |

| Ineligible Assets | Residential property, holiday lets, timeshares |

| Purchase Method | Direct from SIPP funds or via SIPP borrowing (up to 50% of the fund’s value) |

| Rental Income | Paid into the SIPP tax-free |

| Capital Gains | No CGT on property sale within the SIPP |

| VAT Handling | SIPPs can register for VAT to reclaim input tax on purchases |

| Lease Requirements | Must be on commercial terms; arm’s-length agreement with tenants (even your own business) |

| Management Responsibility | Property must be professionally valued, insured, and maintained regularly |

What Do Financial Experts Think About SIPPs?

Financial professionals in the UK generally agree that SIPPs offer strong benefits for the right investor—but they also warn that they’re not suitable for everyone.

Below are a few expert insights from across the industry.

Quotes from Financial Advisers or Experts

Here are some thoughts from financial advisors or experts in the SIPP field related to particular features of this type of pension.

Managing Inheritance Tax (IHT)

In 2023, Caitlin Southall, Senior Marketing Executive at Curtis Banks, said:

‘Fundamentally, SIPPs offer the opportunity for a continued accumulation, investment, and decumulation cycle as wealth is passed between generations, while also offering the potential opportunity to reduce IHT paid.’14

On Flexibility and Control

‘This way I can run my entire savings pot and trade as often as I wish,’ said Stuart Kirk, Financial Times columnist and former banker. ‘SIPPs allow a broad range of investments too, from hedge funds and closed-ended trusts to commercial property and even land.’15

On Suitability and Oversight

‘Different clients require different levels of flexibility and SIPPs are not a one-size-fits-all product,’

Claire Trott, Director and Head of Pensions Strategy, Association of Members-Directed Pension Schemes in 2020.16

Case Studies or Success Stories

Case studies or success stories are a good gauge to help you understand the benefits of a SIPP.

Case Study 1: Business Owner Buys Commercial Property Through a SIPP

Source: Talbot Muir17

David, a UK business owner, used his £250,000 pension pot to buy his company’s £200,000 commercial premises via a SIPP.

| Action Taken | Result |

|---|---|

| Registered for VAT | Reclaimed VAT on the property purchase |

| Property leased back to his company | Created arm’s-length rental agreement to generate tax-free income |

| Remaining £50k SIPP funds invested | Portfolio diversified beyond property |

What Were the Benefits Achieved?

- No capital gains tax on future property sale

- Tax-free rental income into the SIPP

- £200,000 released for business expansion

- Strong legal separation of assets from personal wealth

- Future IHT benefits for his heirs

Case Study 2: Family Uses SIPPs for Joint Ownership and Inheritance Planning

In this case study, devised by IPM SIPP Administration, the tax-efficient use of SIPPs for joint property ownership and inheritance lets a family keep and use their assets across generations.18

Mr and Mrs Jones jointly owned a £300,000 commercial property via their SIPPs and held £100,000 investment portfolios each.

Their long-term goal: preserve wealth and pass it on tax-efficiently.

| Phase | What Happened |

|---|---|

| Initial setup | SIPPs received £25,000/year in rental income, taxed at 20% |

| Mrs Jones passed away at age 67 | Mr Jones became sole beneficiary and switched to tax-free drawdown |

| Children designated as beneficiaries | Inherited equal shares in the SIPP, including the property |

| Son later withdrew £30,000 tax-free | Used for a house purchase, while income continued for both heirs |

This helps keep the business going, gives them a steady income, and lets them take out lump sums without paying taxes.

As his wife’s SIPP beneficiary, Mr Jones retains the benefits in the SIPPs, becoming the sole property and rental income beneficiary.

He ceases his income withdrawals since he can draw tax-free benefits from Mrs Jones’s entitlement, and he nominates their two children as equal beneficiaries to his SIPP.

When Mr Jones dies at 72, his children inherit equal shares of the SIPP.

They establish their own SIPPs, each retaining 50% of the property and investment portfolio within a tax-efficient pension wrapper.

They decide to draw a tax-free £1,000 monthly from their SIPPs, and later, the son withdraws a tax-free £30,000 lump sum for a house purchase from his SIPP.

If Mrs Jones had died at 76, any income from her benefits would be taxed at Mr Jones' rate, potentially impacting withdrawal decisions.

Similarly, if Mr. Jones died post-75, the children would pay tax on SIPP withdrawals at their marginal rate, which could influence their withdrawal choices.

Important Reminder:

These case studies are illustrative only. Your outcomes will depend on your income, SIPP provider, estate planning strategy, and market conditions. Always seek advice from a regulated financial adviser before committing to property or inheritance planning within a SIPP.

What Are the Best Alternatives to SIPPs in the UK?

Yes, there are alternatives to SIPPs for those planning for retirement in the UK.

While SIPPs offer tax relief, investment flexibility, and long-term control, they’re not the best fit for everyone.

Depending on your goals, income level, and investment experience, one of the following alternatives may be more suitable.

Pension Alternatives at a Glance

| Pension Option | Best For | Key Features |

|---|---|---|

| Workplace Pension | Employees eligible for auto-enrolment | Employer contributions, default funds, low cost, simple setup |

| Personal Pension | Individuals without workplace schemes | Provider-managed, moderate fees, fixed fund range, tax relief included |

| Stakeholder Pension | Those needing flexibility with low charges | Capped fees (max 1.5%), flexible contributions, basic fund options |

| Defined Benefit Pension | Public sector or legacy corporate employees | Guaranteed income in retirement, based on salary and service years |

| State Pension | All UK residents with sufficient NI contributions | Pays up to £11,900/year (2025); not enough to fund retirement alone |

| Lifetime ISA (LISA) | Under-40s saving for retirement or a first home | Government bonus (25%) on up to £4,000/year; tax-free access at age 60 |

How to Choose the Right Pension Option

| If You Want… | Consider This |

|---|---|

| Simplicity and automatic contributions | Workplace or stakeholder pension |

| Guaranteed retirement income | Defined Benefit scheme |

| Full control over investments and assets | SIPP |

| Early retirement savings with bonus (under 40) | Lifetime ISA |

| Low fees and minimal engagement | Stakeholder or default workplace pension |

You don’t have to choose just one. Many UK savers combine SIPPs with:

- Workplace pensions for employer contributions

- ISAs or LISAs for flexible, tax-free access

- State Pension as a base layer of retirement income

A diversified retirement strategy often offers the best mix of security, control, and tax efficiency.

Remember, each option has its pros and cons, and your personal circumstances, goals, and risk tolerance should guide your choice.

Common Questions

The advantages of a SIPP include greater control over your pension investments, a wide range of investment options, and potential tax relief on contributions.

You can choose to invest in stocks, bonds, property, and other assets, providing flexibility, however, the disadvantages include the complexity and the need for more involvement in managing your pension.

It’s also riskier for those without sufficient investment knowledge, and charges for managing the SIPP can be higher compared to standard pensions.

To set up a SIPP, choose a provider that offers the investment options and flexibility you require.

You’ll need to fill out an application form, provide identification, and agree to the provider’s terms; following this, you can then make contributions to the SIPP, either as a lump sum or regular payments.

Once your SIPP is established, you can begin selecting investments from a wide range of options according to your retirement goals and risk tolerance.

A SIPP offers tax relief on contributions, which can utlimately help reduce your taxable income; contributions to a SIPP are made before tax is deducted, meaning you get tax relief at your highest rate.

In addition, the money in the SIPP grows tax-free, and when you retire, you can withdraw 25% of your pot as a tax-free lump sum.

A Self-Invested Personal Pension (SIPP) differs from other pensions, such as a standard personal pension, by offering more control over how your money is invested.

With a SIPP, you have the freedom to choose a wide variety of assets, such as individual stocks, shares, and property, while other pensions may only offer a limited range of pre-selected investment options.

SIPPs are suited to those with a higher level of financial knowledge or who want to take a hands-on approach to their retirement savings.

The minimum age to open a SIPP and start making contributions is 18 years old.

There’s a product called a Junior SIPP, which parents or grandparents can open and manage on behalf of a minor child.

The maximum contribution limit for a SIPP’s determined by the annual allowance set by the government, which is currently £60,000.

However, the allowance may be reduced if you have a high income or if you have already started accessing your pension benefits.

Furthermore, it’s worth mentioning that you can also utilise any unused annual allowance from the previous three tax years, known as ‘carry forward’, as long as you were a member of a registered pension scheme during those years.

Yes, you can transfer existing pensions into a SIPP.19

This can offer several benefits, including consolidation of pension pots, increased investment flexibility, and potentially lower fees.

Yes, there are restrictions on the types of investments allowed in a SIPP.

Some types aren’t permitted, such as residential property (unless it is used for a commercial purpose), tangible personal assets like artwork or antiques, certain types of unregulated investments, and investments that would breach HMRC rules.22

It’s crucial to ensure that any investments made within a SIPP adhere to these rules to maintain the tax advantages associated with the pension scheme.

Yes, you can contribute to a SIPP and a workplace pension simultaneously, and many people choose to have both types to maximise their retirement savings and take advantage of the benefits offered by each.23

Junior SIPPs are a great way to start saving for your child’s future. By contributing to a junior SIPP, you can help your child build a financial nest egg for education, a house, or other life goals.

Junior SIPPs offer tax benefits and can potentially grow significantly over time. However, it’s important to consider your child’s long-term financial needs and seek professional advice before opening a junior SIPP.

In Conclusion

A Self-Invested Personal Pension (SIPP) can be a powerful retirement planning tool—but only if it matches your financial goals, investment experience, and tax situation.

For UK investors who:

- Are higher or additional-rate taxpayers

- Want full control over pension investments

- Plan to hold long-term assets like shares, ETFs, or commercial property

- Are confident making investment decisions or working with an adviser

A SIPP could deliver greater returns, lower tax exposure, and intergenerational wealth planning opportunities.

However, if you:

- Prefer a hands-off approach

- Want guaranteed retirement income

- Have a small pension pot or limited investment experience

- Prefer simple, low-maintenance options

You may benefit more from a workplace pension, stakeholder plan, or even a Lifetime ISA.

A SIPP is not a one-size-fits-all solution—but when used correctly, it offers one of the most tax-efficient and flexible ways to build retirement wealth in the UK.

If you're unsure, speak to an FCA-authorised financial adviser to assess whether a SIPP fits within your broader pension strategy.

Found an Error? Please report it here.

100% private. No pressure. Just friendly guidance.

100% private. No pressure. Just friendly guidance.