PensionBee Review (2025): Get the Latest Info!

See How Much Your Future Pension Income Could Be In Just 60 Seconds — No Fees, No Obligation.

How Much Could You Unlock?

Why Homeowners Trust Us

Try Our Free Pension Calculator

Quick, Safe Estimate

No Commitments

Key Takeaways

- PensionBee simplifies pensions by combining old pots into one easy-to-manage, app-based account with no paperwork.

- Annual fees range from 0.50% to 0.95%, with discounts for pots over £100k and no hidden charges.

- Best for UK savers who want ethical investment options, transparency, and a user-friendly alternative to traditional pension providers.

PensionBee is a UK-based online platform that helps you consolidate multiple pension pots into one easy-to-manage plan, giving you a clear view of your retirement savings in one place.

With eight managed plans covering various risk levels—ranging from cautious “Preserve” funds to socially responsible “Impact” and “Fossil Fuel Free” options—PensionBee lets you tailor your strategy while keeping annual fees between 0.50% and 0.95%.

Unclaimed pensions are a real concern in the UK: research by the Pensions Policy Institute shows that up to 3.3 million pension pots, worth about £31 billion, are lost owing to job changes, relocations, or poor record-keeping.1

By consolidating your pensions with PensionBee, you reduce the risk of losing track of these assets and may increase clarity on performance trends over time.

With over 10,000 Trustpilot reviews and an “Excellent” 4.6/5 rating, PensionBee consistently earns high marks for seamless transfers, robust customer support, and user satisfaction.2

In this review, you’ll gain expert insight on:

- Plan performance and fund management

- Fees vs quality and transparency

- Transfer timelines and real user experiences

- Limitations and regulatory safeguards

Understanding these factors thoroughly could help you decide if transferring your pensions to PensionBee is the smart move to secure and optimise your financial future.

In This Article, You Will Discover:

What Is PensionBee and How Does It Work?

PensionBee is a UK-based pension consolidation platform that enables individuals to aggregate legacy workplace and personal pensions into a unified, digitally managed retirement solution.

Designed for individuals who have changed jobs multiple times or lost track of past pensions, PensionBee streamlines retirement accumulation by providing a real-time, centralised dashboard of all pension holdings under active management.

Through its secure online interface—accessible via web and mobile applications—users can monitor contributions, evaluate plan-level fund performance, reallocate investments, and manage decumulation strategies post-55.

Upon enrolment, PensionBee initiates correspondence with legacy pension providers to identify and transfer existing pension entitlements, expediting a traditionally administrative-heavy process.

Contributions are allocated to one of eight discretionary-managed PensionBee portfolios, calibrated for specific risk tolerances and ESG or Shariah-aligned investment mandates.

Here’s how PensionBee stands out:

- Expedited Transfer Processing: Defined contribution scheme transfers are generally completed within 12–15 business days, contingent on third-party provider responsiveness.

- Transparent Fee Model: Annual all-in fees range between 0.50% and 0.95%, with tiered reductions applicable to assets exceeding £100,000.

- Transparent Portfolio Management: Each plan clearly discloses its investment strategy, fund manager, and historical performance.

With over 10,000 reviews on Trustpilot and a rating of 4.6/5 (Trustpilot), PensionBee has positioned itself as a leading solution for savers looking for clarity, convenience, and confidence in their pension planning.

Uncertain whether PensionBee aligns with your retirement objectives? Keep reading to find out who PensionBee is ideal for, how it compares to other providers, and what the real drawbacks might be—before you make a decision that impacts your financial future.

Who Can Join PensionBee?

PensionBee is open to most individuals with an existing UK pension—whether from a previous employer or a personal scheme.

The service is designed to help you consolidate your old pensions, so you must have at least one eligible pension pot to begin.

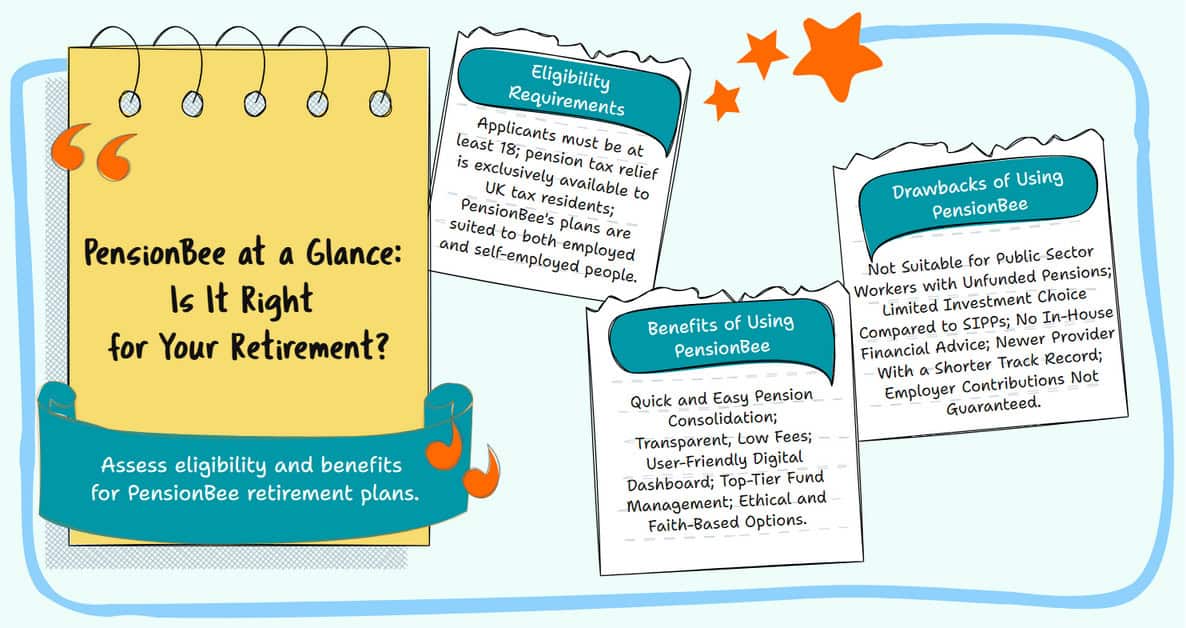

Eligibility Criteria

- Applicants must be aged 18 or older and hold a transferable UK-based pension arrangement.

- Nationality and residency: Anyone can join, regardless of nationality or current country of residence. However, pension tax relief is exclusively available to UK tax residents or individuals qualifying under HMRC’s 'relevant UK individual' criteria.3

- Self-employed or employed: PensionBee is suitable for both. For the self-employed, it acts as a full personal pension. For employees, it can supplement your workplace scheme.4

Not Eligible

Certain pension types are not eligible for transfer, including:

- Unfunded public sector pensions, such as those from the NHS, the Armed Forces, the Civil Service, and teachers, firefighters, and police forces.

- Final salary pensions (defined benefit) may be transferred, but are subject to stricter rules and require regulated financial advice if valued over £30,000.

Can My Employer Contribute?

Yes, but there’s a caveat. Your employer is not legally required to contribute to your PensionBee plan unless it's their designated workplace pension.

However, if they agree, they can make regular payments through bank transfer or payroll setup.

What Are the Benefits of Using PensionBee?

PensionBee combines simplicity with smart pension management, offering several standout advantages for UK savers.

Benefits include:

- Quick and Easy Pension Consolidation: Combine multiple old pensions into one online plan, reducing the risk of lost pots—an issue affecting over £26.6 billion in unclaimed UK pensions.5 Transfers are typically completed within 10–15 working days, handled directly by PensionBee.6

- Transparent, Low Fees: Annual fees range from 0.50% to 0.95%, with a 50% discount on the portion of your savings over £100,000. There are no extra charges for switching plans, drawdown, or exiting (unless your funds have been with PensionBee for under a year).7

- User-Friendly Digital Dashboard: The “Beehive” dashboard (web and app) gives real-time access to your pension, including balance tracking, performance graphs, plan switching, and withdrawal management—all in a clean, intuitive interface.8

- Top-Tier Fund Management: Pension plans are managed by respected investment firms like BlackRock, HSBC, and State Street, offering built-in diversification without needing DIY investing knowledge.9

- Ethical and Faith-Based Options: Choose from the Climate or Shariah plans—ideal for investors with environmental, social, or religious considerations.10

What Are the Drawbacks of PensionBee?

While PensionBee offers simplicity and ease of use, there are some limitations that may make it less suitable for certain types of investors.

A closer look:

- Not Suitable for Public Sector Workers with Unfunded Pensions: You cannot transfer pensions from unfunded public sector schemes—such as those from the NHS, Armed Forces, Civil Service, teachers, police, or firefighters—into a PensionBee account. These pensions are restricted by government rules and must remain with the original scheme.11

- Limited Investment Choice Compared to SIPPs: PensionBee offers seven pre-managed plans, which cover a range of risk profiles and ethical preferences, but it does not allow you to pick individual stocks, funds, or asset classes. Experienced investors may find this too limiting compared to platforms like AJ Bell or Interactive Investor.12

- No In-House Financial Advice: PensionBee does not provide regulated financial advice. While customer support is available, you’ll need to seek independent advice for complex scenarios—especially when considering transferring defined benefit pensions.13

- Newer Provider With a Shorter Track Record: PensionBee launched in 2016, making it relatively new in the pensions market.14 While its fund managers are highly reputable, some savers may prefer providers with 20+ years of historical performance data.

- Employer Contributions Not Guaranteed: Your employer is not required to contribute to your PensionBee plan unless it’s the official workplace pension scheme. While some may agree to pay in, this must be arranged manually.15

What Pension Plans Does PensionBee Offer?

PensionBee offers a choice of seven professionally managed pension plans, each designed to align with different risk appetites, investment goals, and personal values.

These plans are managed by leading global investment firms including BlackRock, HSBC, and State Street Global Advisors.

You’ll be enrolled into either the Global Leaders (if under 50) or 4Plus (if 50+) plan by default, but you can freely switch between plans at any time via the app.16

Here’s an overview of the available plans:

| Plan Name | Manager | Risk Level | Core Focus |

|---|---|---|---|

| Global Leaders17 | BlackRock | High | Invests in ~1,000 large-cap global shares—default for under-50s |

| 4Plus18 | State Street | Medium | Balanced growth, targets 4% above Bank of England’s base rate over at least 5 years—default for 50+ |

| Tracker19 | State Street | Medium | Passively tracks global equity and bond markets |

| Pre-Annuity20 | State Street | High | Designed to align with future annuity pricing |

| Preserve21 | State Street | Low | Focuses on capital preservation via high-quality bonds |

| Shariah22 | HSBC & State Street | High | Fully Shariah-compliant, governed by Islamic finance principles |

| Climate23 | State Street | High | ESG-aligned, invests in companies reducing their carbon emissions |

Key Points:

- Plans are diversified geographically and across asset classes, with risk and asset mix varying by plan.24

- There's no minimum investment25

- Switching plans is free, with changes taking effect instantly within the digital dashboard26

Fund Performance & Historical Returns

PensionBee offers a variety of plans managed by leading investment managers BlackRock, State Street, and HSBC.

But how have these funds actually performed?

While historical returns do not predict future outcomes, they serve as a benchmark for fund stability and volatility metrics.

| Plan Name | 3-Month Return (as of 31 March 2025) | 3-Year Return (Annualised) | 5-Year Return (Annualised) |

|---|---|---|---|

| 4Plus Plan | 0.3% | 4.7% | 7.5% |

| Global Leaders Plan | not available yet | not available yet | not available yet |

| Pre-Annuity Plan | -1.5% | –7.9% | -4.8% |

| Tracker Plan | -1.7% | 5.1% | 9.6% |

| Shariah Plan | -9.8% | 9.5% | 16.5% |

| Climate Plan | -5.6% | not available yet | not available yet |

| Preserve Plan | 1.2% | 4.2% | 2.5% |

Data accurate as of Q1 2025. Returns are net of all fees and based on model portfolios provided by PensionBee.27

Performance Summary

- Higher Growth, Higher Risk: Plans like Shariah and Tracker are equity-heavy and more volatile but offer higher long-term potential.

- Ethical Considerations: The Climate plan may slightly lag broader markets but appeal to ESG-conscious savers.

What Are the Contribution Limits for a PensionBee Pension?

PensionBee follows standard UK personal pension contribution rules, meaning your annual limits are governed by HMRC tax relief thresholds.

Here's what you need to know:

- Maximum Annual Allowance: £60,000 before having to pay taxes (which applies across all your pensions, not just your PensionBee holdings).28

- Earnings Rule: You can contribute up to 100% of your annual earnings, or £60,000—whichever is lower.29

- Non-Taxpayer Rule: If you earn less than £3,600, you can still contribute up to £2,880, and HMRC will top it up to £3,600 through basic-rate tax relief.

- Tax Relief: Basic-rate tax relief (20%) is automatically applied by PensionBee—you only pay £80 for every £100 invested. Higher-rate taxpayers may claim additional relief via their self-assessment tax return. Tax relief is only available to UK residents or those classified as “relevant UK individuals” under HMRC rules.

Additional Considerations:

- Carry Forward Rule: You may be able to contribute more than £60,000 by using unused allowance from the previous three tax years, if eligible.30

- Lifetime Allowance: Abolished in 2024, so there's no upper cap on your total pension savings from a tax penalty perspective, though standard income tax still applies at withdrawal.31

This makes PensionBee suitable for both regular earners and the self-employed, with built-in tax efficiency for eligible UK-based savers.

Fee Breakdown & Value for Money

One of PensionBee’s key selling points is its clear, all-in fee structure.32

Good to Know:

- PensionBee charges no account setup, transfer, or exit fees.

- Fees are visible via your dashboard and updated in real-time.

Here's what you can expect to pay, and how that compares to other providers:

| Plan Name | Annual Fee (All-In) | Fee Halved Over £100k? |

|---|---|---|

| Global Leaders Plan | 0.70% | Yes |

| 4Plus Plan | 0.85% | Yes |

| Tracker Plan | 0.50% | Yes |

| Climate Plan | 0.75% | Yes |

| Shariah Plan | 0.95% | Yes |

| Preserve Plan | 0.50% | Yes |

| Pre-Annuity Plan | 0.70% | Yes |

All fees are charged annually and automatically deducted from your pension balance.

Real-World Example

Here's an illustration of how much you might pay in fees if you invested £50,000 in one of PensionBee's most affordable plans and with three other pension providers.

| Provider | Annual Fee | Cost per Year |

|---|---|---|

| PensionBee (Tracker) | 0.50% | £250 |

| Penfold (Standard Plan)33 | 0.75% | £375 |

| Moneybox34 | 0.45% | £225 |

| AJ Bell (Growth funds)35 | 0.45% | £225 |

| AJ Bell (Responsible Growth fund)36 | 0.60% | £300 |

Figures for comparison only. Actual costs may vary based on underlying investments.

Value Consideration

PensionBee keeps costs low by:

- Using passive investment strategies where appropriate.37

- Bundling fund and admin fees into one charge.38

- Offering fee discounts on large pots.39

However, for investors seeking DIY control or a broad range of funds/ETFs, a low-cost SIPP (like Vanguard or AJ Bell) might offer better long-term value—if you're comfortable self-managing.

Who Is PensionBee Best Suited For?

PensionBee is ideal for individuals who want a simplified, digital-first approach to managing their pension—especially those with past pensions scattered across former employers.

Its ease of use, ethical investment options, and low barriers to entry make it a smart choice for several types of savers.

Best suited to:

- Freelancers and Self-Employed Workers: If you don’t have access to a workplace pension, PensionBee gives you a low-cost, tax-efficient way to build retirement savings independently.

- Professionals with Multiple Old Pensions: Changing jobs frequently can lead to lost or forgotten pensions. PensionBee helps track them down and consolidates them into one simple dashboard.

- First-Time or Passive Investors: PensionBee’s managed funds remove the complexity of picking individual investments, making it ideal for those without deep financial expertise.

- Ethical and Faith-Based Investors: With ESG-focused options like the Climate plan and a Shariah-compliant fund, it suits savers who want their pension aligned with their values.

- Tech-Savvy Users or App-First Savers: The mobile-friendly platform allows you to view your pension, switch funds, and manage drawdown entirely online, with no paperwork.

Less suited to:

- Hands-On Investors: If you want to select individual stocks, funds, or alternative assets, a Self-Invested Personal Pension (SIPP) may offer more flexibility.

- Members of Unfunded Public Sector Schemes: If you're part of a final salary or unfunded public sector pension (like the NHS or Armed Forces), you may not be able to transfer those pots to PensionBee.

What Is a SIPP (Self-Invested Personal Pension)?

A Self-Invested Personal Pension (SIPP) is a type of UK pension that gives individuals full control over how their retirement savings are invested.

Unlike standard personal pensions, SIPPs let you choose from a wide range of investment options, making them popular with confident or experienced investors.

Key Features of a SIPP:

- Wide Investment Choice

- Tax Relief

- Flexible Access

Let's take a look at each of these features in turn.

Wide Investment Choice:

- Individual shares

- Investment trusts

- ETFs and mutual funds

- Bonds and gilts

- Commercial property (with some providers)

Tax Relief:

- 20% tax relief added at source (basic rate)

- Higher or additional-rate taxpayers can claim more via self-assessment

Flexible Access:

- From age 55 (rising to 57 in 2028), you can take 25% as a tax-free lump sum

- You can use drawdown or buy an annuity with the rest

Who Is a SIPP Suitable For?

SIPPs are best for:

- DIY investors who want to actively manage their own portfolio

- Those with larger pension pots seeking custom strategies

- Individuals investing in non-standard assets or seeking tailored diversification

SIPPs vs Managed Pensions Like PensionBee

While SIPPs offer unmatched control, they also require more time, knowledge, and involvement.

You’ll typically face:

- Platform fees40

- Trading charges

- Greater volatility risk if you self-manage poorly

Does PensionBee Offer a SIPP?

No, PensionBee does not offer a Self-Invested Personal Pension (SIPP).

Instead, it provides a Personal Pension, which is a managed pension plan designed for ease of use, not self-directed investing.

Why Doesn’t PensionBee Offer a SIPP?

PensionBee’s core philosophy foregrounds simplicity and accessibility—removing complexity for users who may be overwhelmed by traditional pension platforms.

Rather than offering thousands of funds or shares to choose from (as SIPPs do), it provides a curated list of seven diversified plans, all professionally managed by trusted firms like BlackRock and State Street.

What You Get Instead:

- Passive Investment Model: No need to select individual stocks or rebalance portfolios.

- Free Plan Switching: Change between PensionBee’s seven plans anytime via the app or web dashboard.

- No Trading or Platform Fees: A single annual fee (0.50%–0.95%) covers everything—simpler than typical SIPP structures.41

SIPP vs Personal Pension: How Is PensionBee Different?

Comparing PensionBee’s personal pension with a traditional SIPP highlights the trade-offs between simplicity and investment flexibility.

Key Differences Explained:

- Control vs Simplicity: SIPPs offer maximum control but demand financial knowledge, time, and attention. Personal pensions like PensionBee are plug-and-play, managed by professionals and suitable for users preferring “set and forget.”

- Cost Structure: PensionBee’s fee covers management, rebalancing, and withdrawals—there are no hidden costs. SIPP users often encounter additional trading or fund charges, which may outweigh any platform fee savings.

- Suitability: Use a SIPP if you're confident building a tailored portfolio, investing in niche assets, or actively trading. Choose a platform like PensionBee if you prefer simplicity, minimal decision-making, and peace of mind with professional management.

This table may help you understand the basic differences:

| Feature | PensionBee | SIPP (e.g. AJ Bell, HL) |

|---|---|---|

| Investment control | Limited (7 managed plans) | Full (shares, funds, property) |

| Investment knowledge needed | Low | High |

| Fees | 0.50%–0.95% all-in42 | 0.1%–0.45% + dealing fees |

| Admin complexity | Low (app-based) | Moderate to high |

| Financial advice | Not included | Optional or external |

So while PensionBee may not suit active traders or DIY investors, it’s a compelling alternative for those who value simplicity, trust in professional fund managers, and mobile-first access.

How Does PensionBee Compare to Other Pension Providers?

PensionBee competes directly with other ready-made personal pension providers like Penfold, Moneybox, and traditional SIPP provider AJ Bell (via managed portfolios).

Here’s how it stacks up:

Fees & Costs

- PensionBee: Charges a single annual fee between 0.50%–0.95%, with a 50% discount on the portion of your pot above £100,000. No additional costs for transfers, withdrawals, or plan switches.43

- Penfold: Also applies a single fee (£0.75% standard, 0.88% Shariah). On a <100k pot, Penfold charges 0.4% on the excess portion (0.53% on the Shariah plan).44

- Moneybox: Charges an annual fee of 0.45% (and 0.15% on balances above £100,000).45

Investment Choice & Suitability

- PensionBee: Offers seven ready-made plans with ethical or Shariah options—ideal for passive investors and those conscious of ESG.

- Penfold: Offers four ready-made funds, including Shariah and ESG plans.46

- Moneybox: Offers four ready-made funds, including Shariah and ESG plans.47

- AJ Bell & other SIPPs (interactive investor, Fidelity): Provide access to thousands of assets (shares, ETFs, funds), suited for DIY investors but with more complex fee structures

User Experience & Accessibility

- PensionBee: Mobile-first design, quick setup, and free plan switches. Appealing to users who prioritise simplicity.

- Penfold: Also app-based and fast to set-up, but with potentially higher fees than PensionBee for pots under.48

- Moneybox: Provides educational features and round-up savings but does not support employer contributions.49

- AJ Bell & Other SIPPs: Best for hands-on investors who want full market access and are comfortable with DIY investing.50

Overall Comparison Snapshot

| Feature | PensionBee | Penfold | Moneybox | AJ Bell (SIPP) |

|---|---|---|---|---|

| Fee (≤ £100k) | 0.50–0.95% | 0.75–0.88% | ≈0.45% | 0.25% on shares; 0.25% on funds up to £250,000 + trading fees51 |

| Fee (> £100k) | Reduced by 50%52 | 0.4% (0.53% on Shariah plans)53 | 0.15%54 | (0.1% on the next £250,000, 0% on the portion over £500,000) |

| Investment Range | 7 managed plans | 4 managed plans | 4 managed funds | Thousands of assets |

| ESG/Shariah Options | Available | Available | Available | DIY via fund selection |

| Set-up and Switching | Free & app-based | Similar | Similar | Platform-dependent |

| Employer Contributions | Possible | Possible | Not available | Supported by default |

Summary:

- PensionBee is ideal for those wanting simple consolidation, ethical choices, and a mobile-first experience.

- PensionBee offers a wider range of plans than Penfold and has a low-cost Tracker option, unlike the latter.55

- It’s easier to set up56 and better value than Moneybox, which charges an additional investment fee.57

- AJ Bell and other SIPPs offer greater investment flexibility but require higher engagement and come with more complex fees.

What Do PensionBee Reviews Say?

PensionBee enjoys consistently high customer satisfaction, primarily due to its easy transfers, smooth app experience, and responsive customer support.

Online review scores:

- PensionBee holds a 4.6/5 Trustpilot rating based on nearly 12,000 reviews.58

- PensionBee holds a 3.96/5 rating on Smart Money People based on just over 20 reviews.59

Positive Themes

- Fast & frictionless transfers: “From the very start it's been an easy to use system with minimal fuss.”60

“The process was very easy… would highly recommend.”61 - Helpful customer service: “Helpful staff at the end of the telephone always kept you informed very good service.”62

- User-friendly app: “Simple and intuitive.”63

Criticisms & Concerns

- Performance fluctuations: Some users note short-term losses or slower growth compared to DIY SIPP alternatives. (“Any returns... poor”)64

- Higher fees compared to low-cost SIPPs: Community advice suggests that while convenient, PensionBee’s fee (0.50–0.95%) might be higher than some budget SIPP options (“PensionBee is also a SIPP… paying much much more at PensionBee for no good reason.”)65

Overall Verdict

PensionBee is highly regarded for consolidation convenience, transparent fees, and excellent service, with a strong Trustpilot score.66

However, users seeking lower fees, active DIY control, or alternatives for ethical zero-cost offerings in low-cost SIPPs may prefer other providers.

How Do You Open a PensionBee Pension Account?

Opening a PensionBee pension is designed to be fast, paperless, and user-friendly.

The process can be completed in just a few minutes online or via their mobile app.

Step-by-Step Process

- Visit the PensionBee Website or Download the App: Available for iOS67 and Android68

- Create Your Account: You'll need to enter your full name and email address, add your existing pensions, and provide details (if known) about your old pension providers or upload past pension statements. (If you don’t have this information, PensionBee can attempt to locate your pots for you.)

- Choose Your Pension Plan: Select one of the seven managed plans that aligns with your goals or values. You can switch plans later for free.

- Fund Your Pension: Start contributing with a debit card or bank transfer. You can also set up recurring contributions.

Documents You May Need

- Proof of identity (e.g. passport or driver’s licence)

- Proof of address (e.g. utility bill, bank statement)

You won’t need paper forms unless required for specific legacy pension providers.

What Happens Next?

PensionBee will:

- Contact your old providers to initiate transfers

- Keep you updated via email and dashboard notifications

- Consolidate the funds into your chosen plan once transfers are complete (usually within 10–15 working days)

Is PensionBee Regulated and Safe to Use?

Yes—PensionBee is authorised and regulated in the UK and offers strong safeguards for customer assets.

Here's how your pension is protected:

Regulatory Oversight

- Financial Conduct Authority (FCA): PensionBee is authorised and regulated by the FCA (Firm Ref: 744931), which means it must meet strict standards for transparency, conduct, and customer protection.69

- Financial Services Compensation Scheme (FSCS): If PensionBee or one of its fund managers were to fail, your pension is protected under the FSCS up to £85,000 per provider.70

Asset Custody and Fund Safety

- Your pension is held securely with large, FCA-regulated fund managers—including BlackRock, State Street, and HSBC—not by PensionBee itself.

- PensionBee never directly handles your funds. These are safeguarded in trustee-controlled pension schemes under the BeeKeepers Pension Scheme.

Platform and Data Security

- Encrypted account access

- Two-factor authentication (2FA) for login

- Regular system monitoring and vulnerability scanning

- PensionBee is ICO registered and follows GDPR rules for data protection

Customer Satisfaction & Stability

- PensionBee is a publicly listed company on the London Stock Exchange (Ticker: PBEE) and operates with high levels of transparency and financial reporting.71

- Backed by strong user reviews (4.6/5 Trustpilot) and over £5 billion in assets under administration.72

What Should You Consider Before Choosing a PensionBee Product?

Before committing to a PensionBee pension, it’s important to weigh key factors like costs, flexibility, investment preferences, and long-term goals.

Here’s what to evaluate:

1. Fees vs Value

- PensionBee charges 0.50%–0.95% annually, depending on the plan.

- You get full fund management, mobile access, and free switching—but no DIY investing.

- For pots over £100,000, the fee is halved on the portion above that amount.

Compare this with platforms like AJ Bell (0.25%) or Penfold (0.75%) depending on your need for simplicity vs flexibility.

2. Plan Flexibility

- You can switch plans anytime, with no penalty—useful if your goals or risk tolerance change.

- However, you’re limited to seven pre-set portfolios. If you want to pick individual assets, you’ll need a SIPP.

3. Contributions & Transfers

- PensionBee accepts one-off or recurring payments by card or bank transfer.

- You can also consolidate older pensions, provided they aren’t from unfunded public sector schemes (e.g. NHS, Armed Forces).

- Employer contributions are possible but not automatic — you’ll need to arrange this manually.

4. Digital Access & User Experience

- The Beehive dashboard is intuitive and designed for mobile-first users.

- Real-time balance, drawdown features, and plan details are accessible via app and web.

5. Tax & Retirement Planning

All standard UK pension tax benefits apply:

- 20% tax relief added automatically

- Additional relief claimable if you're a higher-rate taxpayer

- 25% of your pot tax-free at retirement

- You’ll need external advice for more complex tax or withdrawal strategies.

Taking time to assess these points will help ensure PensionBee fits both your short- and long-term retirement strategy.

Frequently Asked Questions (FAQs)

PensionBee charges a single annual fee that ranges from 0.50% to 0.95%, depending on the pension plan you choose.

This fee covers:

- Investment management

- Plan administration

- Platform access (web and app)

- Customer support

Discount: For pension pots over £100,000, the fee on the portion above that threshold is halved.

Additional costs: There are no hidden fees—no charges for switching plans, withdrawing funds, or transferring out.

Yes. PensionBee is authorised and regulated by the Financial Conduct Authority (FCA) and your money is held by large fund managers such as BlackRock and State Street—not by PensionBee itself.

Additional safety measures include:

- FSCS protection: Your pension is protected up to £85,000 per provider

- Data security: Encrypted login, GDPR compliance, and two-factor authentication

- Public listing: PensionBee is traded on the London Stock Exchange (PBEE)

Transferring a pension to PensionBee is simple:

- Sign up online or via the app

- Provide details about your old pension providers

- PensionBee contacts them and initiates the transfer on your behalf

- You’ll receive updates during the process

Timeframe: Most transfers complete within 10–15 working days, though older or manual providers may take longer.

Yes. While PensionBee is designed for pension consolidation, you don’t need an existing pension to start one.

If you’re self-employed or haven’t yet started saving for retirement, you can open a new personal pension with just £1 and begin making contributions via card or bank transfer.

Yes—employer contributions are allowed, but they are not automatic.

To receive them:

- You must arrange the payments directly with your employer or payroll department

- Contributions must be made from a UK bank account

- PensionBee will apply the usual tax relief rules on your behalf

Note: PensionBee is not a government-approved auto-enrolment workplace pension, so contributions aren’t mandatory.

No. PensionBee is designed to consolidate your pensions into a single account. However, you can transfer multiple pots into that account and switch between plans at any time.

Your PensionBee pension can be passed on tax-free if you die before age 75. After that, it’s taxed at the beneficiary’s marginal rate. You can nominate beneficiaries directly through your dashboard.

Generally no. PensionBee follows UK pension rules, which restrict withdrawals until age 55 (rising to 57 in 2028)—unless you qualify for early access due to serious ill health.

Not currently. PensionBee does not offer Junior SIPPs or pensions for children. It’s designed for adults with UK pension eligibility.

Yes. PensionBee allows full flexibility. You can pause or cancel contributions at any time without penalty.

No. PensionBee does not provide regulated financial advice. For personalised investment guidance, you should speak to an independent financial adviser (IFA).

Conclusion: Is PensionBee Right for You?

PensionBee offers a modern, user-friendly solution for UK savers looking to consolidate and manage their pensions in one place.

With seven diversified plans, transparent fees, and strong regulatory safeguards, it’s an ideal platform for a particular set of savers.

These include:

- Individuals with multiple old pensions they want to combine

- Self-employed or freelance workers seeking a simple private pension

- Savers who want ethical or Shariah-compliant investment options

- Users who prefer a mobile-first experience with minimal admin

However, it may not be the best fit if you:

- Want to actively manage your own investments (you’d likely prefer a SIPP)

- Are a member of an unfunded public sector scheme, which cannot be transferred

- Prioritise rock-bottom fees over ease and convenience

Ultimately, PensionBee strikes a balance between cost, simplicity, and accessibility—making it an excellent choice for many everyday savers, but less suited to those with complex needs or high involvement investing goals.

Found an Error? Please report it here.

100% private. No pressure. Just friendly guidance.

100% private. No pressure. Just friendly guidance.